On July 24, Tesla released its second-quarter 2024 financial data.

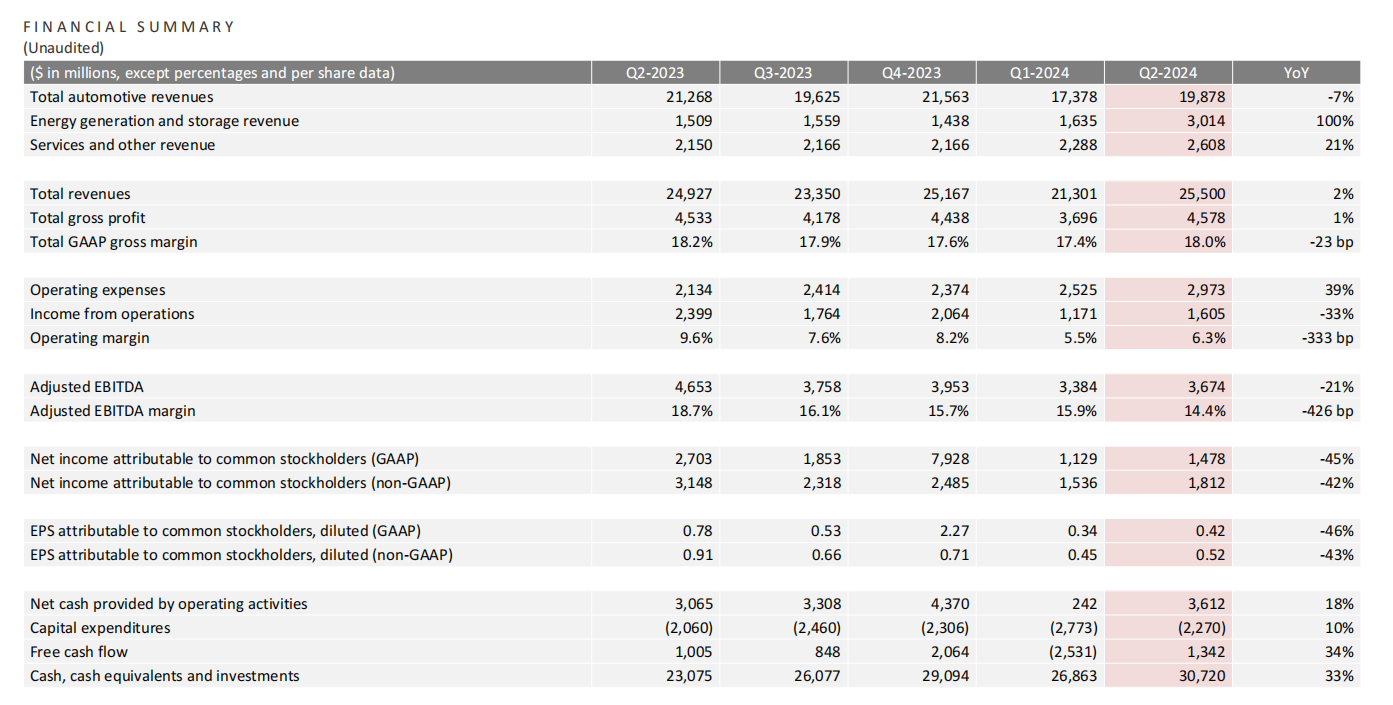

According to the financial report, Tesla's revenue in Q2 was $25.5 billion, a year-on-year increase of 2%. The revenue growth was due to the growth of the energy storage business, while the revenue of the automotive business fell 7% year-on-year to $19.8 billion. In the second quarter, Tesla's net profit was $1.478 billion, a year-on-year decrease of 45%.

Tesla delivered a total of 444,000 new vehicles in Q2, a year-on-year decrease of 4.8%, a year-on-year decline for two consecutive quarters, but better than the market expectation of 439,300 vehicles. Tesla produced 410,831 vehicles in the second quarter, a decrease of 14% from the same period last year.

Tesla remains by far the best-selling electric vehicle in the United States, but its market share is being diluted by a growing number of rivals, in part because of its aging and less competitive lineup of sedans and SUVs.

Tesla offered discounts and other incentives in China and the U.S., including subsidized financing deals, to stimulate demand in the second quarter. Those moves reduced the company’s profitability, with adjusted profit margins falling to 14.4% from 18.7% in the second quarter of 2023.

According to data tracked by Cox Automotive, U.S. electric vehicle sales increased 33% year-on-year in the first half of 2024, while Tesla's sales fell 9.6% during that period.

In China, the Shanghai Super Factory continued to play an important role, with deliveries reaching 71,007 units in June and domestic sales increasing to 59,261 units. July is expected to set a record for the highest domestic delivery volume in a single quarter.

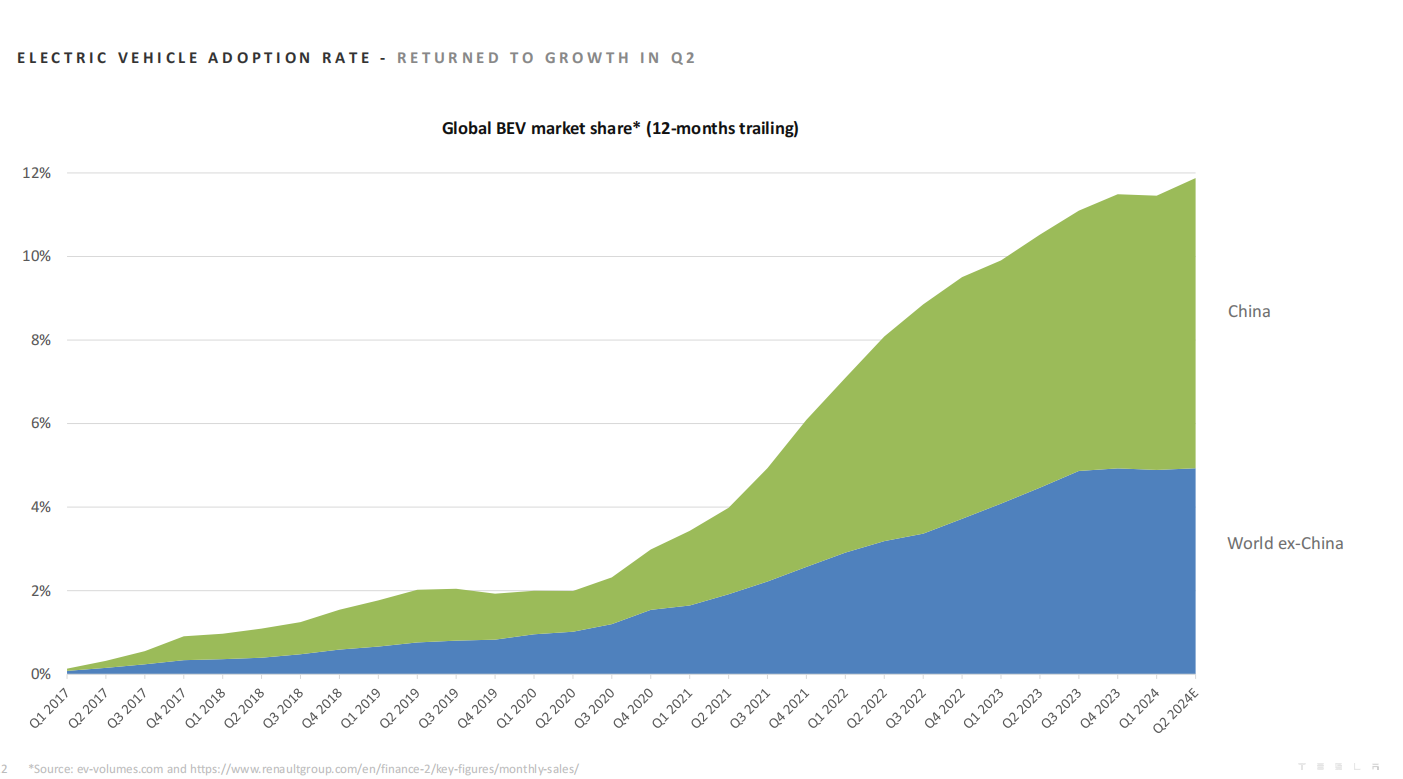

The good news is that the global share of electric vehicles rebounded in the second quarter, and fuel vehicles are being replaced at an accelerated pace.

Compared with the automobile business, the energy storage business has become a new growth point for Tesla. Tesla wrote in the report, "We deployed 9.4GWh of energy storage products in the second quarter, which is the highest quarterly deployment volume to date."

Tesla made more progress in core technologies such as artificial intelligence, autonomous driving, and batteries in the second quarter. Tesla lowered the price of FSD (supervised version) in North America and offered a free trial to all consumers with the necessary hardware, laying the foundation for profitability of fully autonomous driving vehicles.

The humanoid robot Optimus has begun to perform tasks autonomously in the Tesla factory. Unlike an automatic robotic arm, Optimus performs tasks not based on pre-set parameters, but through the "autonomous consciousness" formed by a complex model.

In the second quarter, Tesla produced more than 50% more 4680 batteries than in the first quarter. The cost of the new battery is continuously improving and will be tested and verified in vehicles in July. Once the 4680 battery is installed on a large scale, the competitiveness of Tesla electric vehicles will be greatly increased.

It is worth noting that although its performance faced many challenges, Tesla's stock price rose by more than 10% in early trading, reaching a high of $231.14, the highest level since mid-January this year.