It is generally believed in the industry that the era of smart electric vehicles has entered a knockout stage, and the time to see the results will be between 2024 and 2025. But now it seems that the process of closing, suspending, merging and transferring, and the survival of the fittest is not that fast.

On one hand, NIO launched a new brand to fill the mid-range market, and on the other hand, Aiways and HiPhi, which had just been "eliminated", are "coming back to life". The chaos in the Chinese market is far from over.

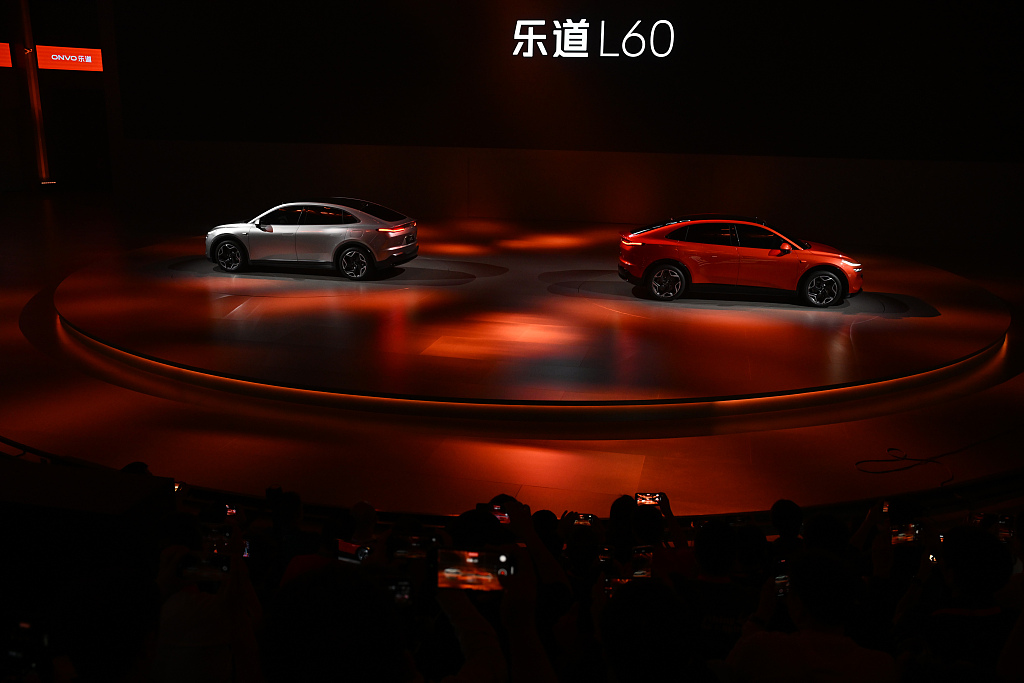

NIO's second brand Ledao is launched and its first car is unveiled

Event overview : NIO’s second brand “Ledao” was launched, with the pre-sale price of its first model, Ledao L60, being RMB 219,900.

On May 15, 2024, in Shanghai, the first model L60 of Ledao Automobile, a subsidiary of NIO, was officially unveiled.

Comment : First of all, NIO needs to be talked about, in terms of finance, brand positioning and other aspects.

In the past eight years, NIO's cumulative net loss has reached 97.4 billion yuan. The extremely high R&D investment is one of the main reasons for the loss, reaching more than 43 billion yuan. As we all know, the more cars are sold, the more the R&D costs can be diluted.

Ledao will share some of the underlying technologies with NIO, such as the NT3.0 platform models. Once the volume is increased, NIO's cost pressure will be much smaller.

In terms of brand positioning, Ledao is also necessary. It can do things that NIO cannot do, such as affordable models. You know, it takes a lot of effort for a Chinese luxury brand without historical background to be recognized by the market. NIO has gone from EP9 to FE competition, from building a bull house to a full set of supporting services, not to mention the most comprehensive energy replenishment system in China.

Having finally secured its status as a luxury brand, if it launches lower-priced models, it would undoubtedly be an invisible waste of previous investment.

Therefore, it is impossible for NIO to launch an ES8 air version or an ET5 youth version. This practice of lowering the price will destroy the luxury tone. Low-priced models can only be made by Ledao.

In this way, those who have the ability to do so can choose Weilai, while those who are new to the industry can buy Ledao. Both parties share some technology and resources, but differentiate themselves in terms of service rights and interests, which is enough to reassure Weilai users and satisfy Ledao users.

It is reported that the intention deposit order for Ledao L60 has reached 100,000.

AIWAYS turns to Europe

Event Overview : Recently, according to media reports, the long-silent AIWAYS has shifted its business focus to Europe and signed a business merger agreement with a special purpose acquisition company in the United States. People familiar with the matter revealed that the company that signed the agreement with AIWAYS is Hudson Acquisition Corp., a SPAC listed on the Nasdaq in the United States. The company will provide electric vehicles for the European market through a business merger with AIWAYS Europe.

Comment : In Aiways' layout, overseas markets have always been a key business.

AIWAYS' first product was launched in the European market in April 2020. Currently, AIWAYS has entered more than 17 overseas markets including France, Germany, the Netherlands, Belgium, and Denmark.

However, it should be noted that its overseas sales performance is not outstanding. According to third-party statistics, Aiways’ cumulative deliveries in Europe have not exceeded 2,000 vehicles.

In other words, it is not that Aiways is unwilling to take a bite of such a big cake in China, otherwise it would not be possible to build a Shangrao factory with an annual production capacity of 300,000 vehicles. But after losing the battle in the Chinese market, Aiways moved its business overseas, calling it a business adjustment, but in fact it was just grabbing the last straw.

When people mention AIWAYS, they don’t think of a clear label. Technology, service, design, quality… AIWAYS has almost nothing to do with the necessary labels for a successful brand. It is just like an ordinary passerby.

Or perhaps, Aiways, which does not seem to have strong product strength in China, can achieve a "dimensionality reduction strike" in the European market. After all, users there have a low threshold for intelligence, and a sufficiently smooth voice system may be enough to impress consumers.

But a serious question is, when Aiways cars are still manufactured domestically and when Europe is planning to escalate sanctions on Chinese-made electric vehicles, is the lifeline that Aiways is holding on to really strong enough?

There is progress in rescuing Gaohe

Event overview : The ambiguity between HiPhi and Changan came to an end, and iAuto Group emerged, offering to invest up to US$1 billion to help Human Horizons (HiPhi's parent company) start rebuilding its team and resuming production.

The scope of cooperation between the two parties includes but is not limited to production coordination to complete sales orders, equity mergers and acquisitions, technical cooperation, brand and international sales docking, and related integration of supply chain and production manufacturing. It is reported that iAuto will fully support HiPhi Auto's resumption of work and production.

Comment : Companies with original capabilities like HiPhi still hope to continue operating for a long time.

The content of HiPhi’s cooperation with iAuto Group this time is very specific.

Specifically, they include: cooperation in resuming production to fulfill sales orders; cooperation related to equity restructuring and mergers and acquisitions; cooperation in technology, R&D, and engineering; integration of brands and domestic and overseas marketing, and integration of supply chain and production manufacturing.

iAuto is registered in the United States and was co-founded by professionals involved in finance, investment and consulting services, with extensive expertise in the automotive industry. iAuto also has a large amount of technical reserves and holds international patents in the field of clean energy vehicle powertrain and motor systems. Media sources have learned that the ultimate beneficial owner of iAuto is Yang Rong, chairman of the Zhengdao Group and the single largest shareholder, who is also the former chairman of Brilliance Auto.

Regarding the resumption of production cooperation, various sources say that it is already underway, but given Yang Rong's series of behaviors after fleeing to the United States, the outside world is not optimistic about the prospects of this cooperation.