After the super luxury car brand Porsche was forced to abdicate by its dealers, it took the lead in forcing out a "joint statement".

On the evening of May 24, multiple insiders revealed that due to unsatisfactory sales, Porsche China chose to push inventory to dealers in order to complete sales targets. However, dealers who sold cars at a loss were no longer willing to bear the huge financial pressure. Therefore, some Porsche dealers stopped picking up cars to "force the palace" from the headquarters, demanding subsidies and replacement of senior executives.

On May 6, 2024, local time, in Saxony, Germany, a Porsche employee inspects an all-electric Porsche Macan at the quality control center of the Leipzig plant.

Li Yanwei, a member of the Expert Committee of the China Automobile Dealers Association, posted on Weibo that before May 1, Porsche investors sent a letter to Porsche, demanding compensation from Porsche China for the recent losses from the sale of new cars. Currently, about 65% of dealer investors have not picked up their cars. He also revealed that Porsche headquarters has sent an investigation team to China, and on May 25, Porsche's global sales director came to China to listen to the report from the China region. Li Yanwei also mentioned that due to the high price of new cars, dealers lack confidence in the newly launched pure electric Macan, and currently only less than 20 units have been sold nationwide.

Two days after the incident became a hot topic, on the evening of May 27, Porsche China issued a joint statement with all authorized dealers.

The statement is titled "Dispel the clouds, gain insight, and move forward - a joint statement from Porsche China and all authorized dealers."

The statement said that the current automotive industry is undergoing unprecedented major changes. Porsche China and its dealers are facing a number of complex issues, with opportunities and challenges coexisting. Porsche China and all authorized dealers have always maintained a long-term, trusting and normal dialogue mechanism. During the period of industry change and transformation, automakers must always actively listen to the voices of dealers from the front line. Only by working more closely and supporting each other can manufacturers and dealers better meet the needs of Chinese consumers in accordance with local conditions and achieve sustainable win-win development.

“Through in-depth discussions, Porsche China and all authorized dealers will jointly seek effective ways to actively respond to market changes and discover new opportunities amid challenges. These discussions cover many aspects, including but not limited to business policies, local customer insights, customer service, and electrification transformation and other key areas.”

The statement finally stated that in the face of the wave of industry change, all authorized dealers will work with the brand to brush away the clouds, gain insight into the right views, and move forward, so as to achieve long-term development in the new historical stage of the automotive industry.

Some industry insiders believe that the wording of this joint statement is quite sophisticated, achieving the effect of "saying everything and saying nothing".

In fact, Porsche entered the Chinese market in 2001. Although there have been occasional twists and turns in the past 20 years, the overall trend is to advance rapidly along with the development of the Chinese economy. It is regarded as the representative of the most successful automobile brand in China.

In 2015, the Chinese market jumped to become Porsche's largest single market in the world, with annual sales of approximately 58,000 vehicles that year. In 2021, sales reached a record high of 95,700 vehicles.

However, in 2022, Porsche China's development reached a turning point. The total delivery volume in the Chinese market that year was 93,286 vehicles, a year-on-year decline of 2.5%, making it the only declining market in the world;

In 2023, China continued to be the only declining market for Porsche worldwide, with full-year deliveries of 79,300 vehicles, a year-on-year decrease of 15%. Not only did the decline widen, but the Chinese market also gave up its position as Porsche's largest single market, which it had previously held for eight consecutive years. The North American region that took over delivered 86,100 new vehicles in 2023, a year-on-year increase of 9%.

Data shows that Porsche sold 18,095 vehicles in China from January to April this year, down 38.4% year-on-year, and the decline continued to widen.

Obviously, the three-foot-thick ice does not form overnight.

According to outside analysis, Porsche's sales in China have declined in recent years, partly due to the impact of the rapid electrification transformation of the Chinese market.

Porsche's electrification transformation started early. Its first pure electric sports car Taycan was launched in 2019 with a starting price of 898,000 yuan. It was so popular in the market that it became a model for Xiaomi Motors to pay tribute to three years later. In 2023, Taycan sold 4,205 units in China, a year-on-year increase of 27.7%.

Unfortunately, Porsche's electrification process cannot keep up with the transformation speed of the Chinese market. Its second pure electric vehicle, the electric Macan, was not officially released until January this year and was officially launched at the 2024 Beijing Auto Show with a suggested retail price starting at 728,000 yuan.

At a time when competition in China's electric vehicles is so fierce, the pricing of the electric Macan is not attractive. Although electric vehicles currently account for a small proportion of Porsche China's sales, just over 5% in 2023, Li Yanwei revealed that dealers reported that the price was too high and they had no confidence in the electric Macan, which also compounded the current difficulties of Porsche China.

In fact, the difficulties currently faced by Porsche China are challenges that every luxury brand has to accept.

"Everyone is having a hard time this year." A person working for a luxury brand revealed that although the sales of their own brand are not very good, they dare not push inventory to dealers for fear that dealers will "rebel" after they fail to make money.

"Luxury cars are not selling well" is the more obvious feeling of dealers this year.

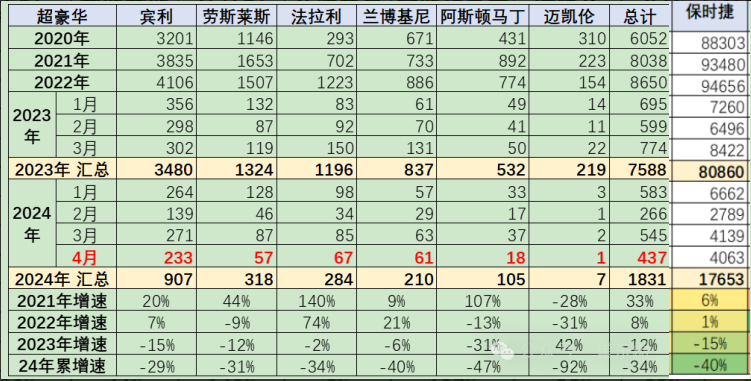

Ferrari's first quarter financial report this year showed that sales in China were 317 vehicles in the first quarter, a year-on-year decline of 20%. "Der Spiegel Pro" made a table showing that super luxury brands such as Bentley, Rolls-Royce, Ferrari, and Lamborghini have seen a uniform decline in sales in China from 2023 to the first four months of 2024. In the first four months of 2024, the lowest decline of these super luxury brands was 29%, and the highest decline reached 92%.

Data shows that China's imports of imported cars have continued to decline from 1.24 million units in 2017, and the import scale has dropped sharply in 2023, with only 800,000 units imported for the whole year, a year-on-year decrease of 10%. From January to April 2024, car imports reached 210,000 units, a year-on-year decrease of 8%, continuing the downward trend of the previous year.

Many industry insiders believe that the unprecedentedly fierce price war in China's auto market has led to a strong wait-and-see sentiment in the market, and the purchasing power of ultra-high-end consumer groups has also temporarily slowed down.

Porsche dealers used to be known for their high-profit image, but now they are mired in losses and are faced with a number of complex issues, opportunities and challenges as pointed out in the "Joint Statement".

How Porsche China solves this problem is expected to serve as a benchmark for the luxury car market.

It is reported that in addition to the electric Macan, Porsche will launch a number of new models this year, including the new Taycan, the third-generation Panamera and the plug-in hybrid model of the 911.

Among them, the new 911 and the world's first mass-produced hybrid 911 will be launched globally on May 28.