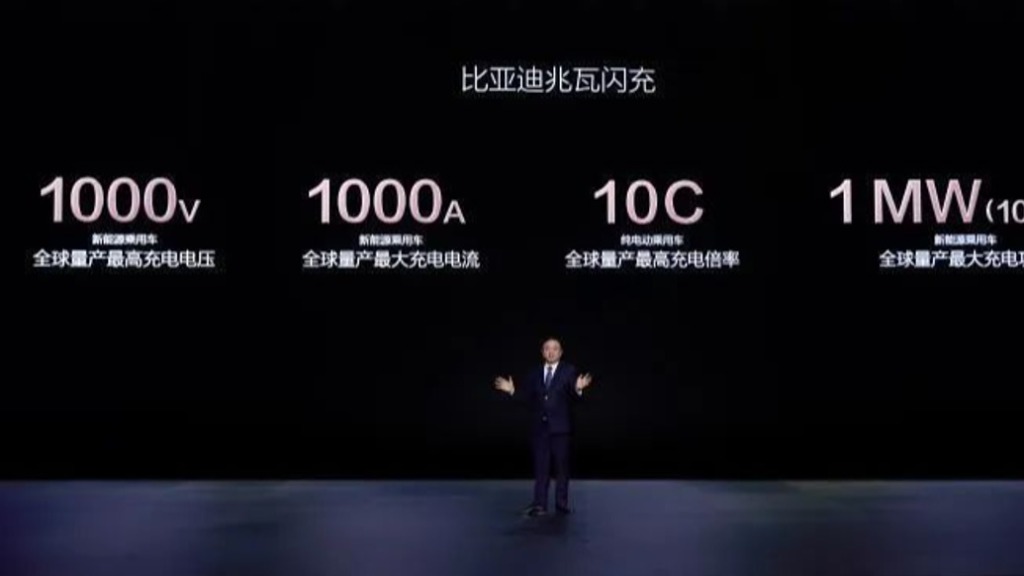

On March 17, 2025, BYD held the "Super e Platform Technology Launch Conference" in Shenzhen. With the theme of "Megawatt Flash Charging at the Same Speed of Oil and Electricity", it demonstrated to the world the breakthrough progress of its new generation of energy replenishment technology - "Megawatt Flash Charging" technology with a charging power of 1 megawatt (1000kW), a voltage of 1000V, and a current of 1000A.

BYD "Super e Platform Technology Conference"

This technology pushes the charging efficiency of electric vehicles to a new level. It has been tested that the Han L model can replenish 407 kilometers of range in 5 minutes, with an average charging speed of 2 kilometers per second, which is almost the same as the refueling speed of a fuel vehicle.

After BYD released this important technology, the fate of NIO has attracted much attention. Some people believe that with such a fast charging speed, how can battery swapping have a future?

Interestingly, on the same evening, NIO and CATL signed a strategic cooperation agreement in Fujian, announcing that they will jointly build the world's largest battery swap network and promote 2.5 billion yuan in capital cooperation.

This move is clearly a response to external doubts. The two major events occurred on the same day, which also reflects the industry landscape of accelerated differentiation of new energy vehicle energy replenishment technology routes.

Technological breakthroughs and industry impact

BYD's megawatt flash charging technology marks a qualitative change in charging efficiency.

Its core technology lies in the combination of the full-range kilovolt high-voltage architecture (1000V) and the 10C high-rate battery. Through the self-developed silicon carbide power chip and fully liquid-cooled charging terminal system, the charging current is increased to 1000A, while solving the heat dissipation and safety problems under high-power charging.

The innovation of battery technology is particularly critical. The "flash charging battery" reduces the internal resistance of the battery by 50% by optimizing the electrode materials and ion channels, and is equipped with an intelligent temperature control system that can accurately adjust the battery temperature in an environment of -30℃ to 60℃, thereby supporting the stability of ultra-fast charging.

The supporting "photovoltaic storage and charging integration" solution buffers the grid load through energy storage stations. For example, in the Shenzhen pilot project, energy storage stations have enabled supercharging stations to have a power self-sufficiency rate of over 60%, effectively alleviating the impact of megawatt-level charging on the grid. BYD plans to build 4,000 flash charging stations by 2025 and cooperate with Sinopec and PetroChina to lay a network. This scale far exceeds NIO's 2,300 battery swap stations by the end of 2024. In terms of efficiency and cost, supercharging technology has posed a direct challenge to the battery swap model. When the charging time approaches the 3-5 minute level of battery swapping, users may prefer charging solutions that do not require battery replacement and have greater compatibility.

Where is the space for battery swapping?

However, although supercharging technology has significantly weakened the efficiency advantage of the battery swap model, judging from the cooperation between NIO and CATL, both parties clearly believe that the latter still has irreplaceable ecological value.

Some people in the industry believe that the core competitiveness of the battery swap model lies not only in the speed of energy replenishment, but also in the battery life cycle management system it builds. For example, NIO provides battery upgrade services through battery swap stations, allowing users to experience the new generation of battery technology without having to replace the entire vehicle. This model effectively improves the value retention rate of used cars.

In the field of commercial vehicles, such as taxis and logistics vehicles, the high-frequency energy replenishment demand is extremely sensitive to battery loss. CATL's "Chocolate Battery Swap" supports quick replacement through standardized battery modules, while supercharging technology may accelerate battery aging due to high-rate charging, making it difficult to meet such high-intensity scenarios.

In addition, the battery swap model is more adaptable in extreme environments. Taking the extremely cold region of Northeast China as an example, the battery swap station maintains stable battery performance through a constant temperature battery compartment, while the supercharging efficiency may drop to 80% at a low temperature of -20℃. This scenario-based advantage also makes the battery swap model still competitive in specific markets.

The competition between the two technical routes is essentially a competition in the industry standardization process. The promotion of supercharging technology depends on the unification of the industry's high-voltage platform, but the current technical routes of car companies are seriously differentiated: Tesla V4 supercharging power is 500kW, Xiaopeng S5 liquid-cooled supercharging power is 800kW, and Weilai still uses a 400V platform. The fragmentation of interface standards and charging protocols may limit the compatibility of megawatt flash charging. For example, existing 400V platform vehicles cannot be directly adapted to 1000V supercharging piles, and need to be indirectly compatible through "intelligent boost" technology, which increases the complexity of technology implementation.

In contrast, in the battery swap model, CATL is trying to break the barriers of car companies through standardized battery modules, such as No. 20 and No. 25 battery swap blocks. Its multi-specification design covers lithium iron phosphate and ternary batteries, and is suitable for commercial vehicles and passenger vehicles, providing the possibility of cross-brand compatibility.

If the battery standardization process is accelerated, the battery swap model may form a more open ecosystem, but supercharging technology may fall into a "each for itself" deadlock due to competition among car companies.

Economic efficiency and the pain point of "different lifespans of vehicle and battery"

Some people have also done the math from an economic perspective. The initial construction cost of a battery swap station is high, about 3 million yuan per unit, but its daily service capacity can reach 300 vehicles, and the marginal cost gradually decreases with scale. The construction cost of a supercharging station is about 1.5 million yuan, which is half the price of a battery swap station. However, due to the limitation of charging time, the daily service capacity of a single station cannot reach 300 vehicles, and the capital investment required for large-scale construction will not be lower than that of a battery swap station.

However, supercharging technology has stronger penetration in the lower-tier markets. BYD can quickly deploy flash charging stations to highway service areas and third- and fourth-tier cities through cooperation with Sinopec and PetroChina, while battery swap stations are mainly concentrated in first- and second-tier cities due to battery reserves and site requirements. Even though NIO started to deploy the "County-to-County" plan this year, the difficulty of construction and laying is still higher than that of charging piles. The difference in regional layout between the two models reflects the differentiation of their target markets.

It is worth noting that one of the clauses in the contract signed between NIO and CATL is to "jointly build a full life cycle closed loop of battery research and development - battery replacement services - battery asset management - cascade utilization - material recycling."

Through closed-loop management, batteries are included in the full life cycle planning from the R&D stage. The long-life batteries jointly developed by NIO and CATL aim to achieve a battery health level of more than 80% after 12 years of use in a battery replacement scenario, far exceeding the industry average of 8 years warranty period.

Between 2025 and 2032, the warranty of about 20 million new energy vehicle batteries will expire, and car owners will face high replacement costs. The closed-loop management proposed by NIO and CATL attempts to systematically solve the problem of "different life spans for vehicles and batteries".

At present, the energy replenishment technology presents a diversified coexistence pattern. BYD cooperates with Sinopec to build a "refueling + supercharging" complex, and NIO integrates supercharging piles in battery swap stations, showing the integration trend of the two technical routes. Supercharging may dominate the daily energy replenishment scene, while battery swapping serves the needs of long-distance travel or battery upgrades. The two are more complementary than substitutable.

However, the final outcome of technological evolution still depends on the resolution of core contradictions. Supercharging needs to overcome the pressure of battery life degradation and grid transformation; battery swapping needs to accelerate the standardization process and reduce ecological barriers.

BYD's "oil and electricity at the same speed" declaration is not only a technological innovation, but also indicates that the new energy vehicle industry is upgrading from single product competition to ecological system competition. Ultimately, the market choice will depend on which technology can more efficiently integrate industrial chain resources - whether it is the ability of supercharging to transform the existing energy network, or the value reconstruction of the entire life cycle of batteries through battery replacement.