Amid the cries of "driving out bad money with good money", the calls to resist "cheating", and the dizzy feeling of falling from the altar, the fierce battle in the auto market in the first half of the year came to an end.

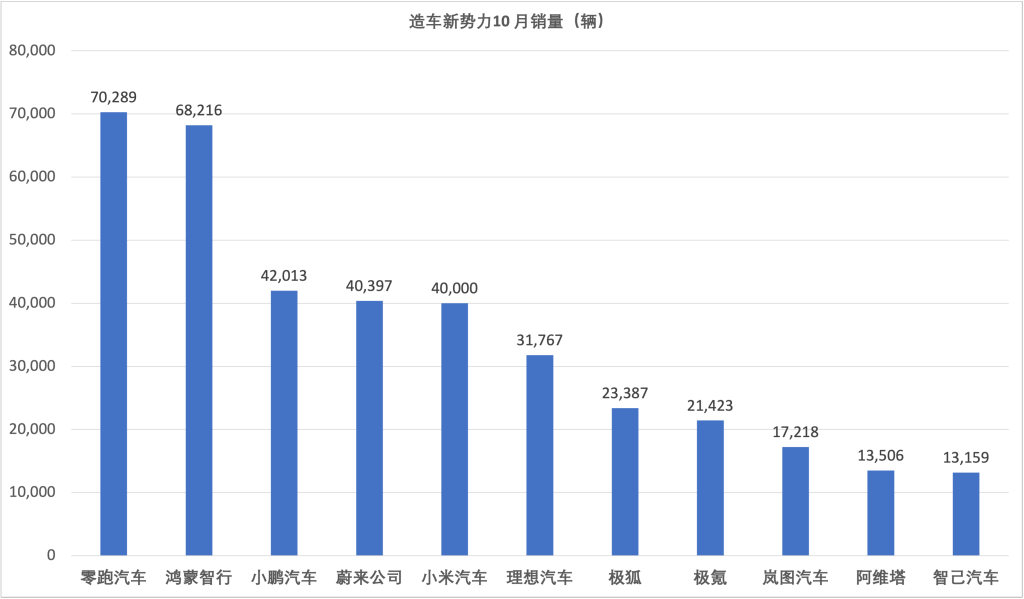

In June, most new players achieved more or less year-on-year growth. From a macro perspective, factors such as mid-year sales and the old-for-new policy drove the growth of the overall market. But from a micro perspective, the situation of each company is different.

Leapmotor almost never participates in hot topics, but it always firmly maintains its position in the first echelon.

In June, Leapmotor delivered 20,116 vehicles, a year-on-year increase of 52.3%, second only to some strong competitors and surpassing many mainstream competitors. It is worth noting that 20,116 vehicles is the highest monthly sales record of Leapmotor.

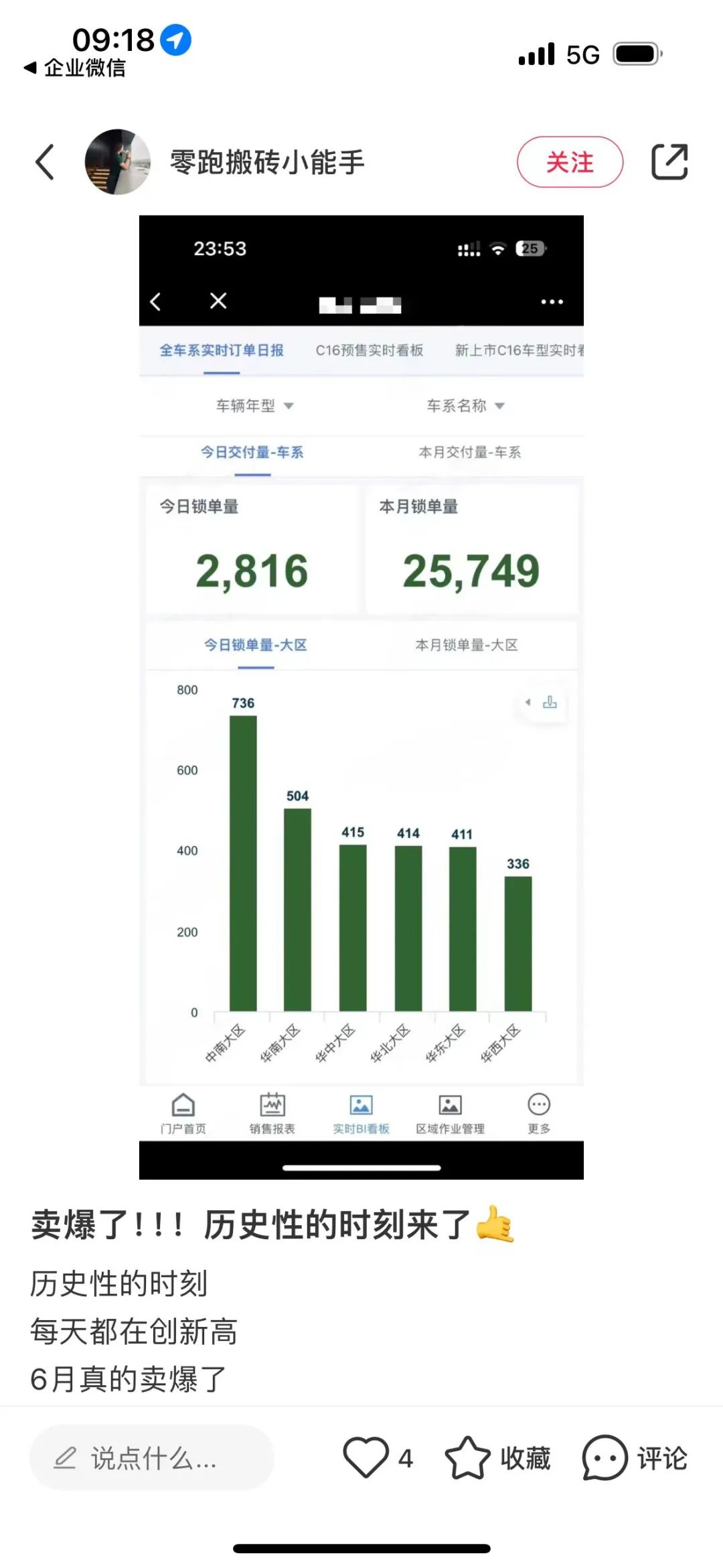

Before Leapmotor announced its sales, a picture of Leapmotor's June order volume was leaked on social media, showing that Leapmotor's June order volume reached 25,749 units, with a single-day order volume of 2,816 units. Generally speaking, automakers do not have a "standard caliber" when announcing sales. Some companies announce the number of licensed vehicles, while others announce the wholesale volume, but the purpose is to choose the caliber with good data to announce.

However, Leapmotor did not release the more impressive “locked order volume” data, which is enough to show that it is a real company.

Judging from the performance in the first half of the year, Leapmotor is also closely following the first echelon. Considering that its locked orders are much higher than the licensed orders, Leapmotor's sales potential in the second half of the year is worth looking forward to.

In fact, Leapmotor has been adhering to a philosophy of life for a long time - be low-key in life and high-key in work.

While the man in red climbed onto the roof of a car to become the "oldest car model" at the Beijing Auto Show, Leapmotor was pre-selling its blockbuster model C16 next door; while traditional car makers complained about Europe's high tariffs on Chinese electric vehicles, Leapmotor had already begun to build a dealer network in nine European countries; while friendly competitors were still arguing over who would sit at the table and who would play the next round, Leapmotor had already hit one "king bomb" after another through its full-area self-research.

It can be said that Leapmotor may not have won in terms of hype, but it has never lost in terms of making cars.

The purpose of technological innovation is to reduce costs, not to increase prices

As usual, Leapmotor releases the "new car family bucket" of the year in March every year. Starting from the "family bucket" in 2023, Leapmotor has been committed to the concept of "luxury equality" and is committed to providing users with a price of 300,000 to 400,000 yuan at a price of 150,000 to 200,000 yuan. Public data shows that since the release of the new car lineup in March 2023, Leapmotor's market performance has been steadily improving.

If the new products released in the 2023 family bucket are already cost-effective, then the new products in 2024 will further maximize the cost-effectiveness. The 2024 C10 is priced at 128,800-168,800 yuan, the new C11 is priced at 148,800-205,800 yuan (the old model is 149,800-219,800 yuan), the new C01 is priced at 136,800-158,800 yuan (the old model is 149,800-228,800 yuan), and the new T03 is priced at 49,900-69,900 yuan (the old model is 59,900-89,900 yuan).

As Leapmotor Chairman Zhu Jiangming said: "We are not afraid of competition, but we are not competing on price, but on value, quality and new technology."

Thanks to the self-developed core technologies, all new Leapmotor cars of 2024 have entered the LEAP3.0 era led by the central integrated electronic and electrical architecture. With the installation of the four-leaf clover architecture and 8295 flagship chip in the Leapmotor C series products represented by C10, Leapmotor has firmly embarked on the right path of "volume value".

With the launch of Leapmotor C16 on June 28, Leapmotor has truly achieved "with the same budget, you can buy products with higher configuration, better quality, and good but not expensive products."

If we use one sentence to summarize the C series, it would be "in the price range of 150,000 to 200,000, it has everything that Leapmotor should have, and also has things that it 'shouldn't have'."

In Zhu Jiangming's words, cars will eventually become durable consumer goods and means of transportation. "Our brand positioning is to provide users with products with higher configuration, better quality, and good but not expensive. No matter how tempting it is, how high the gross profit is, or how big the space is, Leapmotor will always insist on treating cars as mass consumer goods."

What enables Leapmotor to still have room to maneuver within the already tight price range? Leapmotor has explained the "secret" behind it more than once.

Leapmotor insists on self-development in all areas, and develops and manufactures core components that account for more than 60% of the vehicle cost by itself, which can save some cost space. In addition to core components such as batteries, electric drives, intelligent driving, and cockpits, which are all developed by itself, Leapmotor also develops and manufactures headlights and even bumpers to ensure that the product materials are good enough, the technology is strong enough, the experience is better, and the cost is better.

In addition to self-development and self-manufacturing, the consideration of the commonality of the entire product line during vehicle design is also closely related to cost. At present, except for parts related to styling, size, interior and exterior decoration, the commonality rate of parts for models on the same platform of Leapmotor has reached 88%, making R&D more efficient, product consistency better, and cost more optimized.

Another example is the 8295 chip, which is not only used in the cockpit, but also used by Leapmotor for L2 assisted driving. It also integrates audio DSP, parking, surround view and other functions. It not only saves more chips and hardware, but also realizes efficient collaboration between systems and has a lower failure rate.

In addition, Leapmotor has not only reduced costs but also improved the comfort, handling and safety of the entire vehicle through battery-chassis integration technology.

Thanks to the confidence of self-research and self-manufacturing, Leapmotor has redefined the value reference within 200,000 yuan for the industry: whether it is a B-class car or above in size, whether it is equipped with a five-link luxury suspension, whether it is a hybrid with a pure electric range of 200km+, whether it is equipped with the 8295 flagship chip, whether it is equipped with high-end NAP intelligent driving, and whether it is equipped with a 7.1-channel music cabin.

In Leapmotor's car-making philosophy, technological innovation is to allow users to enjoy better technology at a lower cost, rather than to increase the premium by adding flashy functions.

Price cuts without reducing profits, Leapmotor's losses narrow

The essence of business is to make money. It is okay to make concessions, but it is unsustainable to make concessions. However, most car companies are willing to make concessions when they are in a state of internal competition, trying to cut the Gordian knot and drag down their competitors. Little do they know that they may be the first to fall.

As for whether to give up costs or profits, how to measure this degree ultimately depends on the technological maturity and cost control ability of the car companies. Strong technology and low costs will naturally give them more room to maneuver than their competitors.

Leapmotor is undoubtedly on the right path towards sustainable development.

On March 25, Leapmotor released its 2023 full-year financial report, showing that Leapmotor's full-year revenue and delivery volume in 2023 both hit new highs: 144,155 vehicles were delivered throughout the year, a year-on-year increase of nearly 30%; full-year revenue was 16.75 billion yuan, a year-on-year increase of 35.2%, and the growth rate was among the top new forces. Leapmotor's C series accounted for more than 73%, and the product structure continued to improve. In 2023, Leapmotor achieved a full-year gross profit margin for the first time.

According to the first quarter financial report of 2024, Leapmotor delivered a total of 33,400 new vehicles during the period, an increase of 217.9% year-on-year; revenue was 3.486 billion yuan, an increase of 141.7% year-on-year; and net loss also narrowed year-on-year.

On the one hand, there is a steady increase in sales and a gradual decline in prices, and on the other hand, there is a gradually improving profitability. This shows that the "volume value" of Leapmotor is not a false proposition, but a real benefit to the people achieved on the basis of sustainable development through the reduction of technology costs.

Forward-looking layout, accelerated overseas expansion

It is worth noting that when the domestic market is in a state of chaos, the vision of many car companies to go overseas has also been overshadowed. On July 4, the EU's preliminary tariffs on Chinese electric vehicles will be implemented. As the highland of the automobile industry, Europe has always been regarded as an arena for Chinese car companies to prove their strength. At present, this trade barrier will undoubtedly affect the overseas plans of many car companies.

In this respect, Leapmotor can be said to have a long-term vision. On May 14, Leapmotor International, a joint venture between Stellantis Group and Leapmotor with a ratio of 51% to 49% and led by Stellantis Group, was officially established. It is not difficult to find that the core technology of this joint venture is provided by Leapmotor, and the reason why it is dominated by the former is that it can reduce potential obstructions in Europe to a greater extent. After all, since the actual nature is that Leapmotor uses technology to exchange for the market, it can be more humble in its attitude, just like the foreign car companies established joint ventures in China back then.

Moreover, Stellantis has ready-made channel resources in Europe. Compared with those Chinese companies that personally build channels overseas, Leapmotor's overseas expansion process will undoubtedly be faster and more resistant to risks.

In markets without tariff restrictions, Leapmotor will export directly; in markets with restrictions, Stellantis Group will help Leapmotor achieve localized production, that is, Leapmotor will export auto parts and Stellantis Group will be responsible for assembly and production.

According to the plan, Leapmotor International will first start sales in Europe in September 2024, and plans to expand its sales outlets in Europe to 200 by the end of this year, and to 500 by 2026. The joint venture also plans to enter the Indian and Asia-Pacific, Middle East and Africa, and South American markets from the fourth quarter of this year.

In terms of models, Leapmotor International will first launch the C10 and T03 models. In the next three years, Leapmotor International will launch at least one new model every year.

From the security industry to the automotive industry, insisting on full-domain self-development, luxury equal rights, and taking the lead in reverse joint ventures to go overseas, every step of Zhu Jiangming's car manufacturing is pioneering and firm. As Zhu Jiangming said: "Others may have strategic detours, but for us, there is only one way."