On February 11, 2025, the China Passenger Car Association released the latest data showing that the national passenger car market retail volume in January was 1.794 million vehicles, a year-on-year decrease of 12.1% and a month-on-month decrease of 31.9%.

The China Passenger Car Association analyzed that this was mainly due to the early Spring Festival in 2025, which led to fewer working days in January, and the effects of the "double new" policies have not yet appeared.

On January 3, 2025, workers were working in the welding workshop of Changan Automobile Factory 2 in Chongqing Liangjiang New District.

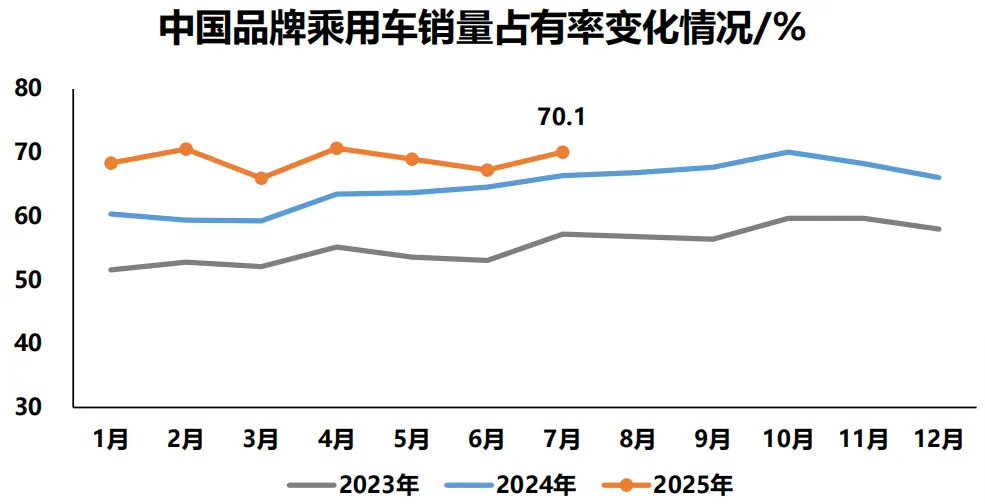

It is worth noting that the wholesale share of domestic brands exceeded 68% and the retail share exceeded 61% in January, up 8 and 6 percentage points respectively from last year. In January, mainstream joint venture brands sold 490,000 vehicles, down 27% year-on-year and 30% month-on-month. In January, luxury car sales were 210,000 vehicles, down 15% year-on-year and 28% month-on-month.

The main reason for the strong performance of independent brands is the strength of their new energy vehicles. In January, the domestic retail penetration rate of new energy vehicles was 41.5%, an increase of 9 percentage points from the same period last year. In domestic retail sales in January, the penetration rate of new energy vehicles among independent brands was 60.6%; the penetration rate of new energy vehicles among luxury cars was 20%; and the penetration rate of new energy vehicles among mainstream joint venture brands was only 3%.

Looking at the manufacturers, BYD's sales in January continued to maintain strong growth. BYD sold a total of 300,538 vehicles, a year-on-year increase of 49.16%, of which passenger car sales were 296,446, a year-on-year increase of 47.5%. A recent National Intelligent Driving Conference indicates that BYD will use a new posture to set off another round of internal circulation craze.

Geely Auto sold 266,737 vehicles in January, up 27% from the previous month and 25% from the previous year, setting a new monthly sales record and surpassing BYD in domestic sales. Geely brand sold 224,718 vehicles in January, up more than 30% from the previous year. Among them, Geely Galaxy series became the main growth driver, with sales reaching 93,545 vehicles in January.

Chery Group sold 224,323 vehicles, up 10.3% year-on-year, with monthly sales exceeding 200,000 for six consecutive months. Chery Automobile's best-selling models include the JETOUR Zongheng series and the Zhijie brand. Chery Group's growth is mainly due to its steady performance in the traditional fuel vehicle market and its continuously improving brand influence and product quality.

Great Wall Motors sold 80,933 vehicles in January, down 22.2% year-on-year. Among them, Haval brand sold 48,600 vehicles in January, down 17.84% year-on-year; Tank brand sold 12,800 vehicles, down 35.99% year-on-year; Great Wall pickup sold 12,300 vehicles, down 20.33% year-on-year; WEY brand sold 5,007 vehicles, up 49.42% year-on-year; and Ora sold 2,193 vehicles, down 63.46% year-on-year.

Overall, among the five major brands of Great Wall, only WEY brand and overseas markets have achieved year-on-year growth. The brand with the most severe year-on-year decline, Ora, had a monthly sales volume of only 2,193 units, a year-on-year decline of 63%.

Currently, Great Wall Motors' square box models such as the Tank 300 and Haval Big Dog have become the main sales force of Great Wall Motors, with sales of 35,000 units in that month.

In January, Changan Automobile's overall sales reached 275,700 units, of which new energy sales were 67,487 units, a year-on-year increase of 26.8%; overseas sales also reached 62,016 units, a year-on-year increase of 10%. Changan brand sales reached 145,551 units in January; Changan Qiyuan brand sales rose steadily, with 10,816 units sold in January, and cumulative sales have exceeded 190,000 units. Changan Kaicheng, Deep Blue Auto and Avita brands also performed well, with sales of 26,491 units, 24,575 units and 8,826 units respectively, of which Deep Blue Auto and Avita brands increased by 34% and 25% year-on-year.

As for joint venture brands, FAW-Volkswagen barely maintained the top spot in the joint venture camp with sales of 137,000 vehicles, but it fell by more than 20% year-on-year. The main fuel models Sagitar and Magotan were significantly squeezed by the plug-in hybrid models of independent brands, and the new energy product line was only supported by ID.4 CROZZ, with sales of less than 5,000 vehicles in January. The lack of transformation led to a continuous shrinking of market share.

Japanese brands collectively suffered a cold reception, with Toyota, Honda and Nissan all experiencing year-on-year declines in retail sales. Taking GAC Toyota as an example, its wholesale volume of new energy vehicles was only 37 units in January.

In January, China's passenger car market showed a clear trend of differentiation. The leading automakers achieved counter-cyclical growth by virtue of their own advantages, while some automakers saw sales decline due to lack of competitiveness. Domestic brands hedged against domestic market pressure through technological iteration and global layout, while joint ventures and luxury brands were constrained by excessive reliance on fuel vehicles and insufficient investment in electrification, and it would be difficult to reverse the downward trend in the short term.

The China Passenger Car Association analyzed that the price war will be most intense in 2023, and will start early, be strong and last long in 2024. Although the strength of automakers in participating in the price war has shown a weakening trend this year, the high profits in the upstream are prominent, and there is still potential for continued price wars in 2025.