Last year, several leading eVTOL (electric vertical takeoff and landing) companies brought manned aircraft to the China International Import Expo (CIIE). This year, low-altitude airspace has once again become one of the most watched industries at the CIIE.

This year marks the second consecutive year that the "low-altitude economy" has been included in the government work report and listed as a key development direction for strategic emerging industries during the 15th Five-Year Plan period. From technology verification to commercial operation, from airworthiness certification to full coverage, eVTOL is gradually transforming the imagination of low-altitude passenger travel into a tangible future.

Immersive low-altitude travel experience: 15 minutes to Suzhou for only 100 yuan.

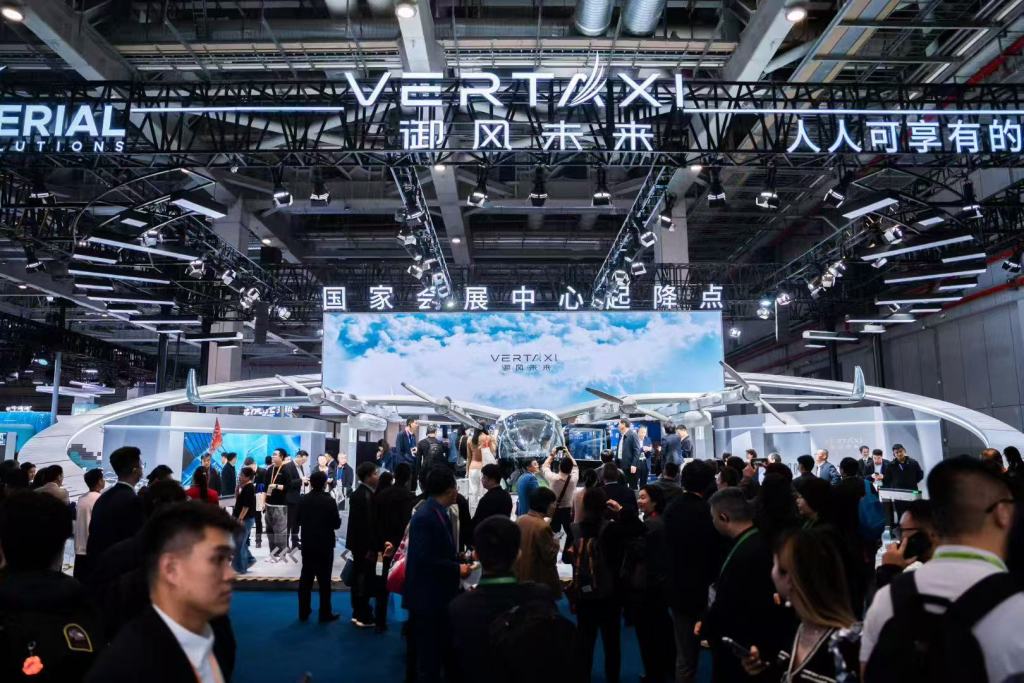

At this year's China International Import Expo (CIIE), Yufeng Future brought its brand-new M1 manned aircraft into the exhibition hall. It also made a groundbreaking breakthrough by building a real-life "future city low-altitude travel take-off and landing point" at the National Exhibition and Convention Center. The panoramic simulation of the urban air mobility (UAM) operation scenario allowed visitors to experience the efficient process of "taking a flight" from scanning a code to buy a ticket, waiting for the flight, and boarding. It became one of the most popular photo spots at the event, attracting a large number of visitors to board and experience the aircraft.

eVTOL take-off and landing sites refer to dedicated locations for the take-off and landing of electric vertical take-off and landing aircraft. They are not only an important part of the future urban air traffic network, but also a key infrastructure for the development of the low-altitude economy.

At the "National Convention and Exhibition Center Take-off and Landing Point" created by Yufeng Future, visitors can check flight prices and simulate booking flights and seats at "automatic ticket vending machines," intuitively experiencing smart travel methods such as "scanning a code to book a flight" and booking trips with one click. Meanwhile, the take-off and landing point also includes security checkpoints, flight information screens, waiting and relaxation areas, aprons, and a model of a low-altitude economic demonstration zone, allowing visitors to not only learn about the operation mechanism of the take-off and landing point up close but also see the future urban network layout of air transportation.

On the simulated flight booking interface, visitors can choose between city and intercity routes from the National Exhibition and Convention Center to destinations such as Lujiazui, Pudong International Airport, Suzhou Jinji Lake, Wuxi Yuantouzhu, Hangzhou West Lake, and Yiwu, Zhejiang. Frequent flights and affordable fares mean you can catch an "air taxi" every 5 minutes. City flights start at 50 yuan, while intercity flights range from 100 to 300 yuan. It takes ten minutes to reach the city center, half an hour to Wuxi, and less than an hour to Hangzhou. According to Yufeng Future's preliminary calculations, once low-altitude travel is widely adopted, a direct flight from the National Exhibition and Convention Center to Yangcheng Lake or Suzhou Jinji Lake will only take 15 minutes, with a ticket price of just 109 yuan.

According to on-site staff, the initial cost of riding the M1 is expected to be slightly higher than that of a taxi. However, the price will decrease further after large-scale operation, ultimately realizing the affordable value of "air taxis." In the future, a flight from the National Exhibition and Convention Center to any district in Shanghai will only take about 10 minutes, and cross-city point-to-point travel will only take 30 to 60 minutes. The ticket price for a seat is expected to be similar to that of a taxi, greatly improving travel efficiency.

Previously, an eVTOL company executive told The Paper that with the expansion of future operations, coupled with cost reductions brought about by technological advancements in core components such as batteries and motors, and the continuous optimization of the supply chain system, they are confident that they can further reduce costs through economies of scale, making low-altitude travel more affordable, but this will take time.

CIIE Centralized Signing Ceremony: Securing 100 Aircraft Orders, Accelerating Overseas Expansion

At this year's China International Import Expo (CIIE), several eVTOL companies signed contracts, with Volant and Time Technology each receiving orders for nearly 100 units.

Among them, VOLANT Aviation signed multiple cooperation agreements with leasing companies Beijing Yizhuang International Financial Leasing Co., Ltd., Beijing Shenzhou Auto Leasing Co., Ltd., and Dubai IC Leasing; operating companies China Flying Dragon General Aviation, Shanxi Success General Aviation, and European DC Aviation; and supplier Xibai Technology. The total order amounted to 95 aircraft and 2.375 billion yuan, marking the fourth confirmed commercial order for high-level commercial passenger eVTOL aircraft and securing tens of millions of yuan in additional deposits.

Currently, the global low-altitude economy is on the verge of explosive growth, and China, with its strong new energy vehicle industry chain and accumulated aviation technology, is rapidly becoming a technology innovator and market leader in the eVTOL field.

Regarding overseas orders, Volant Aviation, together with IC Leasing, a leading global aviation finance company headquartered in Dubai, and DC Aviation, a top German business aviation operator and IC Leasing's long-term strategic partner, signed a purchase order and strategic cooperation agreement for 30 VE25-100 Skyplane aircraft. This is Volant Aviation's second overseas order after Pan Pacific in Thailand. The three parties will work together to explore the Middle East and European markets, promoting Chinese eVTOL technology and products to the international stage.

Time Technology and ICBC Financial Leasing have signed a strategic cooperation agreement, with ICBC Financial Leasing planning to purchase 100 E20 eVTOL aircraft from Time Technology. According to reports, ICBC Financial Leasing, as the largest financial leasing company in China by asset size, will fully leverage its comprehensive financial service capabilities and global network advantages to provide systematic financial support for the E20 eVTOL in various fields, including domestic and international sales, operating leasing, and financial leasing, accelerating the internationalization of the eVTOL industry. Previously, Time Technology had already secured a $1 billion procurement order from a UAE company.

It is worth noting that Shitech signed strategic agreements with representatives from the Bank of China, Agricultural Bank of China, and Shanghai Bank at the China International Import Expo. Shitech successfully secured a total of RMB 700 million in substantial credit lines from the three banks to jointly build a low-altitude economic ecosystem. The loans have been approved and are now being disbursed, and will be specifically used for key aspects such as the construction of a core manufacturing plant, obtaining Type Certificate (TC) airworthiness certification, and core technology research and development.

The capital market continues to pay close attention to companies in the low-altitude economy sector, and leading companies in the industry chain are about to enter an accelerated phase of large-scale commercial application.

During the China International Import Expo (CIIE), Shi Technology also announced the completion of a 300 million RMB Series B++ financing round. This round of financing was jointly invested by China Renaissance Capital, Junshan Capital, and Puhua Capital. This is the company's second round of financing completed in 2025, and its seventh round overall.

For eVTOL OEMs, whose R&D cycles are relatively long, funding plays a decisive role in development. Several eVTOL company founders told reporters that the generally accepted funding scale in China from the start of R&D to obtaining the TC certificate (type certificate) is around 1 billion yuan, with the exact amount fluctuating depending on the company's technology and strategy.

The competitiveness of domestic technology has been further enhanced.

Several leading eVTOL companies reached a key airworthiness milestone last year, and a new phase of eVTOL deployment in China is expected in the next two to three years. Executives from several eVTOL companies revealed that their manned eVTOL models are planned to obtain airworthiness certification by the end of 2026, and commercial operation is expected to begin as early as 2027.

In response to the new challenges of eVTOL in airworthiness certification, during this year's China International Import Expo (CIIE), CETC and AVIC Airborne Systems will jointly establish an "eVTOL Component Airworthiness Certification Collaborative Platform." It is understood that the two parties will jointly develop a certification plan, conduct verification tests, systematically improve airworthiness capabilities, and jointly tackle key areas such as propeller lightweighting and high reliability to ensure the product successfully passes airworthiness certification and accelerates commercialization.

eVTOL companies are also collaborating with upstream and downstream partners to build a safe and reliable industrial chain, further enhancing the competitiveness of domestically developed technologies. Shitech and AVIC Airborne Systems will focus on high-tech barriers in eVTOL development, such as EWIS (Electrical Wiring Interconnection System) and power distribution systems. They will establish a comprehensive collaborative mechanism across technology research and development, manufacturing, and market promotion, jointly building a safe, controllable, stable, and reliable core supply chain system through collaborative technology research and development and capacity building. Shitech points out that this marks a crucial step forward for China's eVTOL industry in achieving core system autonomy and building a secure industrial chain.

Currently, my country's eVTOL technology research and development, as well as its industrial chain development, are at a leading level globally. Previously, an executive from a leading eVTOL company told The Paper that domestic eVTOL OEMs are currently progressing at a research and development speed two to three times faster than their foreign counterparts. Most components in eVTOL products have been domestically produced; only products such as aircraft motors are not yet mature enough in China, requiring more resources from the industrial chain. However, some experts point out that my country's low-altitude economy faces challenges such as low technological maturity and relatively high barriers to entry in key core technologies.

It is worth noting that during this year's China International Import Expo (CIIE), Shitech also announced that its headquarters and manufacturing base will be located in Shanghai, realizing a fully integrated headquarters encompassing R&D, manufacturing, airworthiness certification, and sales delivery. As a leading enterprise in the low-altitude economy sector, the establishment of its headquarters and manufacturing base will strongly drive the agglomeration and development of related industrial chains such as advanced manufacturing and new materials in the Yangtze River Delta region. By building a complete industrial ecosystem, Shitech will attract upstream and downstream enterprises to settle in, forming an industrial cluster effect.

Overall, in the field of manned eVTOL, EHang's EH216-S eVTOL received the world's first type certificate for unmanned manned eVTOL in 2023. This signifies that it possesses both the safety capability for manned operation and the qualification for commercial manned operation of unmanned aerial vehicles. Currently, of the five companies in China engaged in the research and development of manned eVTOL and the first to achieve the maiden flight, four originated in Shanghai, including Fengfei Aviation, Shike Technology, Yufeng Future, and Volant, and they are also accelerating their airworthiness progress.

Currently, the global eVTOL industry is still in its early stages of development. Many companies have entered the low-altitude track but have not yet produced prototypes. Large-scale promotion and popularization across society is still a long way off. However, as competition gradually intensifies, the market's future is promising.