On the evening of March 21, NIO released its latest financial report showing that it delivered 222,000 vehicles in 2024, a year-on-year increase of 38.7%; revenue reached 65.73 billion yuan, a year-on-year increase of 18.2%, a record high, but its net loss expanded by 8.1% year-on-year to 22.4 billion yuan.

On September 25, 2024, a photo was taken of the parking lot of the NIO Automobile Factory located in the Economic and Technological Development Zone of Hefei City.

Its gross profit margin for complete vehicles remained stable at 13.1% in the fourth quarter, and the full-year gross profit margin for complete vehicles increased to 12.3%; the company's comprehensive gross profit margin for the full year increased to 9.9%.

Li Bin made it clear at the earnings conference that 2025 will be the "year of deepening cost reduction" for NIO. The company expects that as the effects of cost optimization are reflected in the financial report, it is expected to achieve quarterly profitability in the fourth quarter of this year, with a gross profit margin target of 20% for the NIO brand and 15% for the Ledao brand.

As a key chess piece for NIO to capture the mainstream market of 200,000-300,000 yuan, Ledao brand quickly rolled out more than 400 stores after its listing in the early fourth quarter of 2024, but 60% of the sales staff are new employees, and it will take time for the stores to release their efficiency. Li Bin admitted that Ledao still needs to "survive the brand recognition climbing period", but its reuse of after-sales and battery swap networks with NIO, as well as cross-brand synergy of sales incentive mechanisms, are injecting momentum into long-term growth.

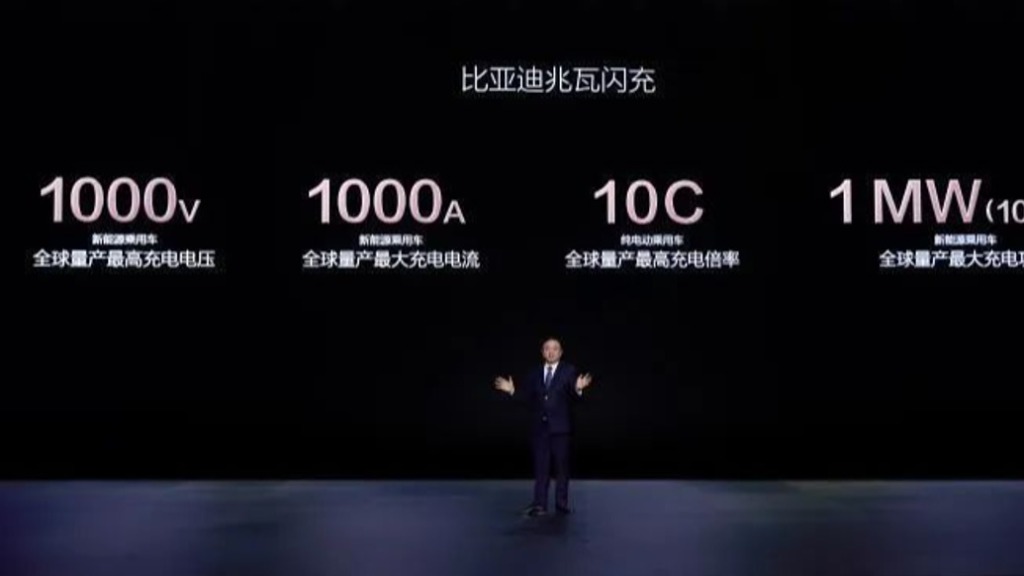

Weilai's strategic ambitions are ambitious, but the challenges cannot be ignored. As of the end of 2024, Weilai's cash reserves are 41.9 billion yuan and its current liabilities are 62.3 billion yuan. Tesla and BYD continue to squeeze the market through their products and flash charging technology, and the competitiveness of other new forces, including the second generation of traditional car companies, is also rising steadily.

However, the battery swap moat that it has invested in for seven years has begun to take shape. It has built the world's largest battery swap network (3,187 as of press time) and created a "rechargeable, replaceable and upgradeable" battery ecosystem. In mid-March 2025, CATL announced that it would invest 2.5 billion yuan in NIO to jointly build a "dual-network parallel" system to promote battery standardization and scale.

In addition, the technology dividends of self-developed chips will be gradually released. It gave up purchasing NVIDIA Thor chips and instead bet on the self-developed Shenji NX9031. It not only avoided the supply chain risk of the 32-week delivery cycle of automotive chips, but also reconstructed the technical foundation through the "cost reverse method". The innovation of chip packaging materials and the improvement of wafer cutting yield have also reduced the cost of a single vehicle intelligent driving system by more than 10,000 yuan.