In the turbulent new energy market in China, the transformation of the channel model is becoming a silent war. Traditional dealers are mired in inventory backlogs and price wars, while direct-sale brands are unable to break through the bottleneck of regional penetration due to heavy asset investment. When the industry is trapped in the "impossible triangle" dilemma of "scale, efficiency, and experience", smart has provided a unique solution with the regional agency system - this is neither a compromise with the traditional distribution model nor a simple imitation of the direct-sale model, but a channel revolution with user value at its core.

Breaking the “Impossible Triangle”: Reconstructing the underlying logic of channels

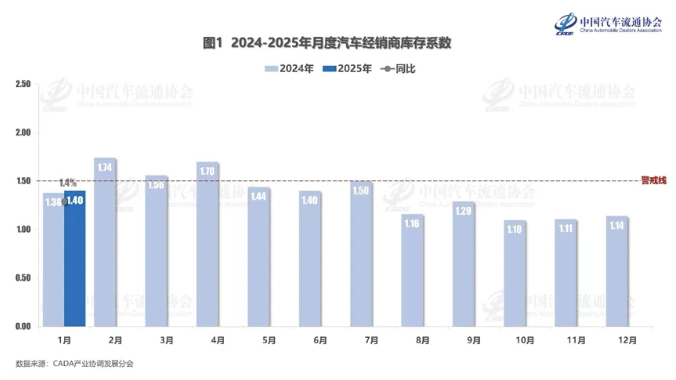

Data from the China Automobile Dealers Association shows that the comprehensive inventory coefficient of automobile dealers climbed to 1.40 in January 2025, which reflects the core pain points of the traditional dealer model - inventory risks, intra-city competition and profit compression.

Under this model, dealers need to bear the vehicle inventory. If market demand is weak, they can only digest the inventory through price cuts and promotions. This not only eats up profits, but also triggers a price war among dealers in the same city.

In addition, multiple dealers of the same brand compete in the same area, leading to serious internal friction. For example, in a prefecture-level city, there were five dealers of the same brand coexisting, and the vicious competition diluted the service quality and user satisfaction.

Furthermore, the combined effect of inventory costs and price wars has significantly reduced dealers’ profits from new car sales. Some dealers even rely on after-sales and financial derivatives to make up for losses, but the rise of new energy vehicles has further squeezed after-sales profit margins.

Although the direct sales model can ensure the consistency of brand tone and service, its drawbacks are also prominent.

Direct-sale stores have to bear high store construction and operation costs, and their expansion speed is limited. For example, although the direct-sale network of a certain American electric vehicle pioneer covers core cities, its penetration in the sinking market still relies on third-party cooperation. And it is difficult for direct-sale stores to quickly cover a wide market, especially in low-tier cities. This leads to insufficient brand reach efficiency and difficulty in capturing long-tail demand.

On the other hand, the direct sales model emphasizes standardized operations, but the flexibility of localized marketing is weak. It is difficult for direct sales stores to launch customized activities for users in specific regions, while traditional dealers are better at such precise and differentiated operations.

In order to solve this pain point, smart targeted this structural contradiction through the regional agency system (D2C).

First, car companies have the power to set prices, ensuring unified pricing and price control across the country, as well as a transparent online car ordering system. At the same time, under the D2C model, car companies can directly obtain information, suggestions and demands from potential customers and car owners. In addition, dealers are responsible for regional operations such as store construction, team training, and market operations. The property rights of the vehicles belong to the car companies, and dealers do not need to carry inventory, but only need to bear a small amount of test drive fees.

In this regard, an investor of a smart agency in Jiangsu said, "If we go back to the previous distribution model, we will find that there are 5 dealers and 5 different investors for one brand in one city. Who will manage the users? Who will pay attention to the users' lives? But it is different now. Smart has handed over this area to me, and I will invest a lot to operate it well. You reap what you sow. If you work hard, you will reap what you sow."

Data shows that by 2024, Smart's domestic sales outlets will exceed 190. Behind this data is a qualitative change in business logic. Agents no longer need to spend most of their energy on inventory turnover and price negotiations. They begin to invest resources in the deep waters of user operations.

Triangular Stable Structure: Reshaping the Trust Chain

The disruptive nature of the regional agency system lies in the reconstruction of the relationship between brands, agents and users. Brands eliminate the root cause of channel internal friction by holding property rights and unifying pricing. Agents obtain market regional operation rights, forming a long-term soil of "whoever invests, benefits". Users get a more transparent and convenient experience through APP direct purchases and exclusive service groups.

This triangular structure has been verified in various markets. Local agents have upgraded the traditional wide-ranging sales to "user circle operations" and significantly increased the repurchase recommendation rate through activities such as camping and city exploration organized by the car owner club.

An investor of a Shandong smart agent believes that the D2C model has liberated their productivity, allowing them to spend more time on product analysis and customer needs, rather than wasting time on wrangling with customers due to excessive price fluctuations. "We have accumulated a lot of time and space, and can focus more on strategic analysis and tactical play, and do more product analysis and customer needs for customers."

The establishment of this trust relationship enables agents to transform from "sales executors" to "localized ecosystem operators."

Precise penetration: three-dimensional layout of channel network

Smart's channel network expansion is not a simple superposition of outlets, but a three-dimensional layout tailored to different needs.

In first-tier cities, inefficient supermarkets are being moved into high-end automobile parks and landmark business districts. According to Liu Yang, head of smart channels, many of the first stores opened by smart in China were supermarkets. The characteristics of this type of store are large traffic and exposure, and it is also very convenient for users to view and purchase cars. However, as time goes by, traffic will decline, but the rent of supermarkets is increasing year by year. "In response to this situation, smart provides our investors with a flexible channel replacement option."

On the other hand, as the brand's popularity grows, there is really no need to rent the property for a long time in a high-rent platinum location. Instead, the property can be moved to an area with a more suitable cost and reasonable distance.

In cities with large areas and strong importance, smart will introduce new investment entities in due course, but will still consider dividing by region. This not only ensures user coverage in high-tier cities, but also reduces the investment and operation and maintenance pressure of individual agents. In the sinking market, the lightweight model of "showroom + shared after-sales" significantly lowers the entry threshold, and the investment cost of a single store in a third-tier city is even lower.

At the same time, smart's agent recruitment policy will provide corresponding customer acquisition support. From online to offline, as long as the agents have enough imagination, this will be a "start-up capital" to open up the market.

New luxury: the value anchor beyond parameter involution

No matter how sophisticated the channel design is, it cannot be separated from the value support of products and brands. When the industry is caught in an arms race between driving range and intelligent configuration, smart has chosen a path that tests strategic determination more. The Mercedes-Benz design team has transformed the century-old luxury gene of the three-pointed star emblem into the "new luxury and smart" language of the electric era.

It is not difficult to imagine that the coupe lines and immersive cockpit of smart #3 may have become the direct reason for users to enter the store and place orders. This phenomenon of "aesthetic transformation" is particularly rare in the new energy market where parameters are paramount.

But the design premium also needs to be protected by the manufacturing system. Based on the intelligent manufacturing capabilities of the SEA vast architecture, the Ningbo factory has created a new model of "European standard verification + China mass production delivery". This means that from the design drawings in Stuttgart to the delivery to Chinese users, smart saves more time than traditional luxury brands. This chemical reaction of "design potential × intelligent manufacturing efficiency" is transformed into unique competitiveness on the channel side.

While competitors are still struggling to increase their production capacity, smart's agents are able to obtain the dual guarantees of product strength and delivery capabilities at the same time.

The enlightenment of channel revolution

The real value of the regional agency system lies not in the technical parameters of the business model, but in its reconstruction of industrial relations. By the end of 2025, when smart has implemented the "zero inventory operation" and "deep user ecosystem" initiatives in 240 outlets in more than 110 cities, what they are writing is not only a successful business case, but also an industrial experiment on trust and efficiency.

This model proves that in the new energy era, channels can be neither cold trading machines nor battlefields of capital, but a value ecosystem nurtured by brands, users and agents.

When art exhibition halls in first-tier cities, community life bases in second- and third-tier cities, and lightweight touchpoints in the sinking market form a network, the value of the channel finally returns to its essence. It is not a cost burden for car companies, nor a testing ground for "pull" with users, but an amplifier of value experience.