At present, the rapid rise of China's automobile industry has put unprecedented pressure on global competitors.

AlixPartners, a consulting firm, recently released the 21st edition of AlixPartners Global Automotive Outlook 2024. The report predicts that by 2030, Chinese brands will become a global dominant force, with overseas sales expected to climb to 9 million vehicles, accounting for one-third of the global market share.

On July 4, 2022, in Yantai, Shandong, a large number of export commodity vehicles gathered at Yantai Port waiting to be loaded.

Stephen Dyer, partner and managing director of AlixPartners, co-head of Greater China and head of automotive and industrial products consulting business in Asia Pacific, warned that established traditional automakers must find ways to compete with Chinese brands, otherwise they may lose the affordable electric vehicle market to Chinese brands just as American automakers lost the domestic small car market to Japanese automakers in the 1980s.

In addition, the report also analyzes the reasons why Chinese automakers were able to overtake overseas automakers in just a few years, and provides an outlook on how Chinese automakers should seek diversified overseas expansion paths in an environment where the global growth rate of electric vehicles is slowing and trade barriers in the European and American markets are high.

Given the influence of multiple factors such as environmental regulations, trade barriers, market demand, and geopolitical competition, the road for Chinese automakers to conquer the world is not always smooth.

China's new energy vehicle companies are only as fast as they can be

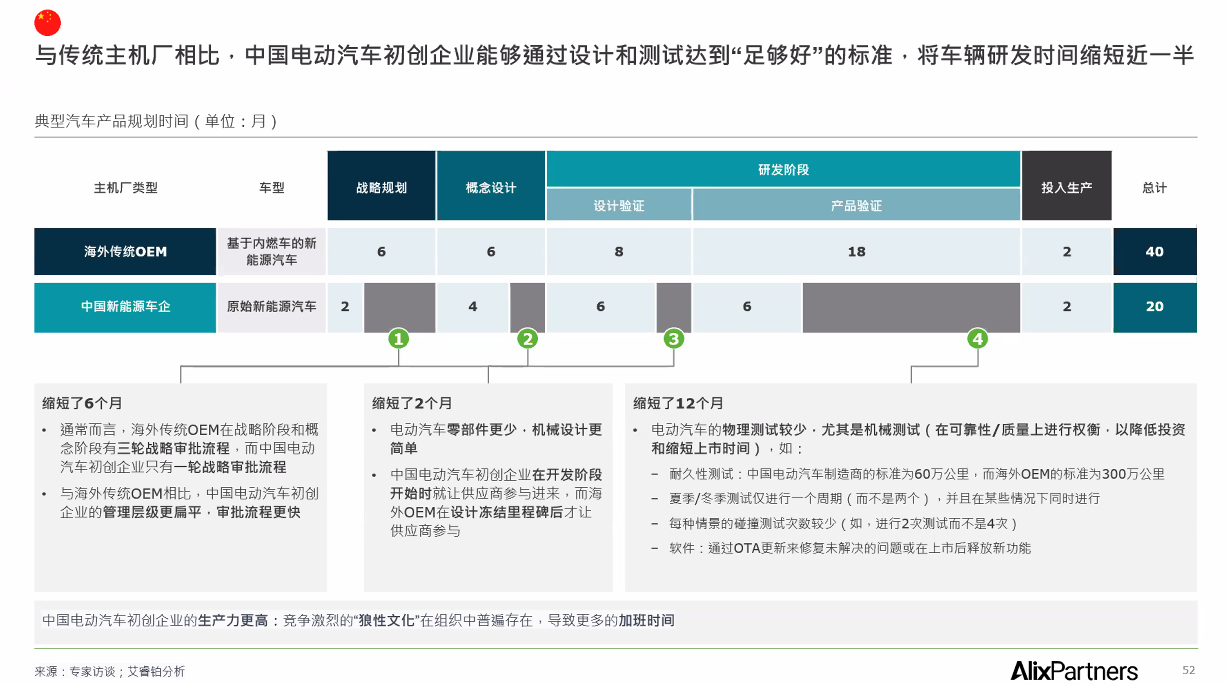

The biggest impression that Chinese new energy vehicle companies, represented by new forces, give to the outside world is "fast". The development cycle of new vehicles is about half or even less than that of traditional car companies.

The report shows that the new car development cycle of traditional car companies is generally 40 months, while that of Chinese new energy car companies is 20 months or even 18 months.

The report analyzes that there are many reasons for the rapid development of new cars. First, Chinese new energy vehicle companies have simplified the development approval process and verification process. Specifically, in the strategic planning stage, overseas car companies have to go through three rounds of approval, while Chinese start-ups only need one round, which can save six months.

During the design phase, overseas automakers involve suppliers after the design is frozen, while Chinese startups involve suppliers in "co-creation" from the beginning of the design, which can save 2 months.

During the R&D verification phase, overseas car companies generally need to undergo 3 million kilometers of road testing, while Chinese start-ups generally need 600,000 kilometers. A recent example is that Volkswagen ID. and other models have undergone two winters and two summers, 3.5 million kilometers of road testing. The recently launched Xiaomi SU7 is still undergoing "road testing" after its launch, and this move is also beautified by the manufacturer as a responsible image of "still testing and adjusting after launch."

The verification and testing phase is the most time-consuming part of R&D. Traditional car companies need 18 months, while Chinese start-ups generally take 6 months. This phase is the key verification phase related to the quality and reliability of new cars.

If every link is faster and more economical, it is not surprising that start-ups can launch new products quickly.

Continuing with the topic of new car verification, the second reason for "fast" is introduced. Domestic startups always put speed to market and customer value propositions such as in-vehicle infotainment systems and intelligent driving assistance technologies first, making trade-offs in traditional ride and handling, noise and vibration, and reliability performance. Zhang Yichao, partner of AlixPartners' Greater China automotive consulting business, pointed out at the report seminar: "In the past, cars were means of transportation, and people considered optimizing mechanical efficiency, but now cars are 'information processors', and people are concerned about information processing capabilities."

Dai Jiahui pointed out that it is difficult for cars today to make differences that consumers can perceive in terms of traditional driving performance, styling, and durability, but smart cabins and smart driving can better reflect the differentiation.

In summary, startups spend their time and energy on things that are visible to consumers, and appropriately give up those time-consuming and low-perceived tasks, thereby shortening the development cycle.

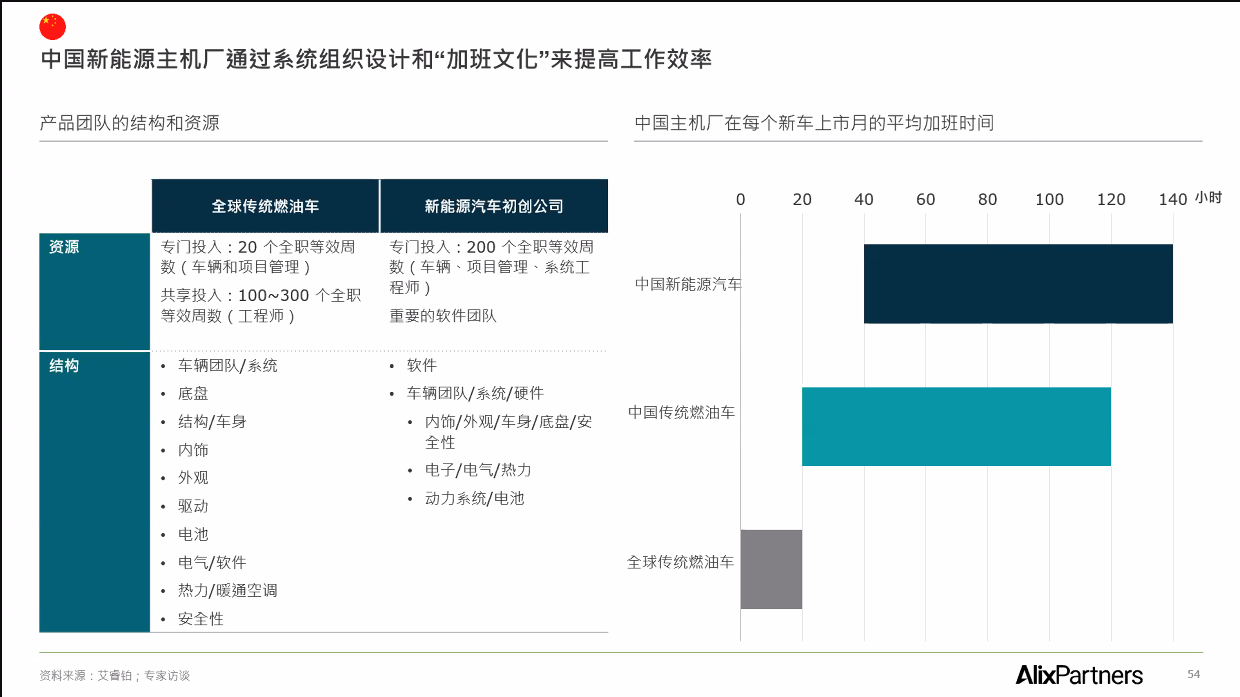

Another reason is that the 996 work schedule is prevalent in China, which is something that engineers from overseas car companies cannot do. The report shows that Chinese startups work 40-140 hours of overtime per month, while traditional overseas car companies work no more than 20 hours of overtime per month.

Chinese automakers have strong integration capabilities

In addition to being fast, China has a complete industrial chain and a rich supply chain. Domestic car companies have stronger vertical integration capabilities than overseas car companies, and they undoubtedly have an advantage in cost and efficiency.

AlixPartners analysis shows that Chinese brands have a cost advantage of up to 35%, giving them the flexibility to lower prices in Europe and other places to offset the impact of tariffs. This advantage stems from lower labor costs and a high degree of vertical integration in all links, covering the entire process from raw materials, parts suppliers, final assembly to sales to other OEMs.

Take BYD as an example. Even if an additional tariff of 17.4% is imposed, it can still achieve the same profit margin as European electric vehicles.

The report shows that 70% of BYD's electric car parts are self-developed and manufactured, and only 30% are from suppliers. This strong vertical integration capability enables BYD to have a dimensionality reduction attack capability in most markets around the world.

In addition, the rapid development of overseas transportation has prompted Chinese automakers to actively safeguard their own logistics capabilities, further paving the way for overseas exports.

Trade barriers push Chinese automakers to seek diversified overseas expansion paths

Chinese electric vehicle manufacturers have a strong motivation to expand overseas in search of more growth. The European and American electric vehicle tariffs are not unexpected for Chinese electric vehicle manufacturers. Zhang Yichao said: "Many Chinese automakers either have mature overseas expansion plans or have invested heavily in establishing final assembly operations in Europe. These new tariffs may further accelerate these localized production plans and help them further develop in Europe."

In addition, Chinese automakers have also circumvented policy barriers by building factories in Southeast Asia, Mexico and other places. For example, BYD and GAC Aion have already completed factories in Thailand.

In fact, even if the factory is not built locally, the increase in overseas costs is not as high as expected. Zhang Yichao explained that the parts of China's electric vehicles are currently divided into three parts: domestically produced parts, domestically produced imported brand parts, and imported imported brand parts. After the whole vehicle is exported overseas, the original "imported parts" and "domestic parts" are equivalent to swapping identities, which can offset part of the cost.

In addition to localized production, another model is to use "technology for market" like the joint venture established by Leapmotor and Stellantis, allowing companies familiar with the local environment, channels, and policies to help sell Chinese cars, which can improve efficiency in the review, research, and channel construction links.

Of course, there is also a relatively rare way - technology licensing. For example, in the factory jointly built by CATL and Ford in the United States, the Chinese side does not invest, but only licenses the technology, and Ford produces the vehicles and then pays CATL a technology licensing fee.

In terms of product strategy, Zhang Yichao pointed out that since Europe has only launched anti-subsidy actions against electric vehicles produced in China, Chinese car companies can continue to export plug-in hybrid vehicles or even fuel vehicles.

AlixPartners expects Chinese brands’ market share in Europe to double to 12% by 2030 from an estimated 6% in 2024.