August 27, 2024, marks a significant day in He Xiaopeng's automotive career.

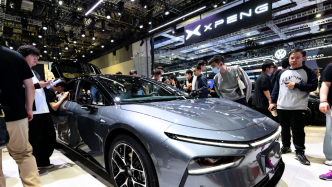

On this day, Xiaopeng Motors celebrates its tenth anniversary, coinciding with the launch event for the MONA M03.

This event is quite grand.

Prior to the official launch, industry leaders such as Changan's Zhu Huarong, Alibaba's Cai Chongxin, GAC's Zeng Qinghong, and Huawei's Yu Chengdong sent their congratulations via video for the tenth anniversary.

On the day of the event, prominent figures like Lei Jun were present to show their support, with media registration numbers nearing a thousand, rivaling the grand scale of Jia Yueting's "Suffocated by Dreams" launch event for LeEco Supercars held in Beijing's Wukesong years ago.

On stage, He Xiaopeng passionately celebrated a decade of dedication, reminiscing on hardships and looking forward to the future; below the stage, "Peng Friends" were moved to tears, cheering enthusiastically, their spirits high.

Ten years in car manufacturing, with annual sales exceeding 140,000 units

The atmosphere at the venue was filled with emotion and excitement, but the market ultimately remains rational. At ten years old, Xiaopeng Motors is still facing challenges.

Sales data shows that Xiaopeng Motors delivered a total of 141,600 vehicles in 2023, with historical cumulative deliveries surpassing 400,000.

In the first half of 2024, total deliveries reached 52,028 units, a 25.6% increase compared to 41,435 units in the same period last year, but only achieving 18.6% of the annual sales target of 280,000 units. According to the latest disclosed numbers, July's deliveries were 11,145 units, with the completion rate for the first seven months also being less than 30% of the annual goal.

In contrast, competitors like Li Auto and NIO have already surpassed six-figure cumulative sales this year.

On a positive note, Xiaopeng Motors' reforms are showing early signs of effectiveness.

In the first half of the year, Xiaopeng Motors achieved revenues of 14.66 billion yuan, a year-on-year growth of 61.2%; the gross margin stood at 13.5%, significantly improved from -1.4% in the same period last year. Among this, revenue from car sales reached 12.36 billion yuan, up 55.7%, with gross margin rising from -5.9% to 6.0%. At least, the operational health is showing a positive trend.

Of course, the new players that have managed to withstand the Chinese market for ten years are not to be underestimated. Since the inception of new car-making in 2014, hundreds of new brands have emerged in China, but only a few dozen still exist, each with unique attributes.

At the very least, in terms of diligence, He Xiaopeng has proven to be more reliable than many former professional managers venturing into car manufacturing.

While the latter may be enjoying hot towels in business class or eating freshly roasted nuts in first class, He Xiaopeng was instead having a 7-yuan chicken leg rice in the urban villages—it's worth noting that at that time, He had already sold UC and served as a senior executive at Alibaba, clearly a financially independent big shot.

It has proven difficult to navigate the critical early stage of transitioning from concept to reality while maintaining a comfortable lifestyle; many startups that allocated funding for high-quality living have exited at various stages.

However, the "suffer first, enjoy later" approach is not unique; Li Bin from NIO was also seen eating takeout at the event.

When He Xiaopeng first crossed over from the mobile internet field to the automotive industry, he experienced a "novice" phase too. During a launch event at the Guangzhou Tower in 2018, he stated, "The essence of a car is operation, not manufacturing," which drew widespread criticism from the traditional automotive industry.

Without sales, how to survive the next decade

Yet, He Xiaopeng always holds a deep respect for the automotive sector. After this incident, he began to delve into the differences between the technology internet industry and the automotive industry.

He later realized that unlike the internet, which follows a long-tail model and strategy, car manufacturing relies on the "short board theory" and resource patterns. Building a car is akin to creating a barrel constructed from numerous boards, where any weak board could impact safety, quality, sales, brand, and more; having only long boards is insufficient to create a masterpiece—it's the short boards that determine the overall systemic advantages.

Guided by this philosophy, Xiaopeng saw the phased success of the P7 and addressed the organizational reforms following the G9's struggles.

Consequently, the newly launched MONA M03 has fully absorbed the "short board theory," striving for balance in design, space, and handling.

In terms of design, the Xiaopeng MONA M03 boasts two golden ratios: one is the golden proportion, with a height-to-length ratio of 3.31, a width-to-height ratio of 1.31, and a tire height ratio of 0.47, surpassing most sports sedans. The other is the golden drag coefficient of 0.194, making it one of the lowest drag production cars globally.

Space is another major advantage of the M03. The Xiaopeng MONA M03 features a maximum trunk capacity of 621 liters, easily accommodating one 28-inch suitcase and four 20-inch suitcases without needing to adjust the seats.

Inside, the Xiaopeng MONA M03 adopts a refined minimalist style, clearly inspired by the Model 3. However, possibly catering to younger consumers' desire for fun or perhaps inspired by Lei Jun, this car has developed several premium accessories. For example, adjustable headrests coupled with memory foam lumbar support, a two-piece sunshade, and a plug-and-play premium dashboard.

In terms of handling, according to on-site presentations, a significant investment was made in the unseen aspects of the MONA M03. The chassis refinement has achieved a 15% superiority in cornering roll control compared to higher-end sedans, with a turning radius of 5.3 meters and a braking distance of 35.6 meters.

However, based on our previous test driving experience, the rear torsion beam suspension seems to have sacrificed some comfort in the overall ride quality.

The Xiaopeng MONA M03 is equipped with Level 2 intelligent driving capabilities, with most of its intelligent driving features focused on parking.

It is reported that the automatic parking feature can cover 100% of high-frequency parking scenarios, boasting a 95% success rate. It can even park in two high-frequency extreme parking scenarios, supporting dead-end street spots and spots with side barriers—this capability is quite practical for young drivers lacking parking experience.

Looking at the pricing for the three configurations at 119,800 yuan, 129,800 yuan, and 155,800 yuan, the MONA M03 aims to achieve high sales volume while moving towards its stated goal of "smart equality" and "technology for all." Thus, the MONA series will directly compete with volume leaders in the A-Class car segment, targeting the sweet spot of 100,000 to 200,000 yuan for exceptional cost-effectiveness.

It is foreseeable that the M03 will secure a considerable initial order volume, and achieving rapid sales growth is essential for He Xiaopeng to usher in the next decade.

In his speech, He Xiaopeng noted that in 2014, there were 300 car brands in China, but this year only 40 remain above a significant scale. Xiaopeng Motors has survived the first decade's preliminary selection.

According to He Xiaopeng's predictions, in the next ten years, only seven mainstream brands will remain in the Chinese automotive market. He believes that any brand failing to reach an annual sales target of 1 million units will struggle to become a final victor.