On May 21, Xpeng Motors released its first quarter financial report for 2024.

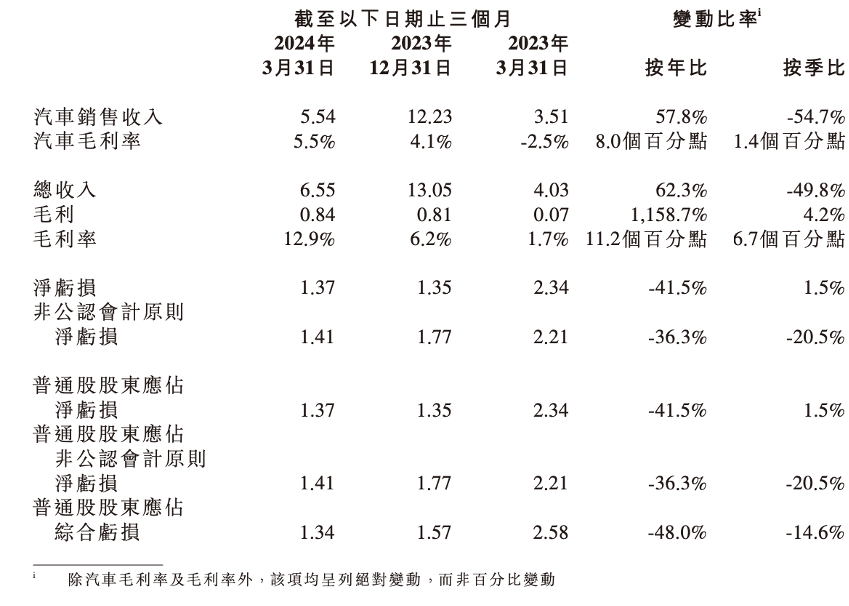

According to the financial report, Xpeng Motors' revenue in the reporting period was RMB 6.55 billion, up 62.3% year-on-year and down 49.8% month-on-month. Its net loss in the first quarter was RMB 1.37 billion, a significant narrowing of 41.5% year-on-year and a slight expansion of 1.5% month-on-month.

Revenue fluctuations are positively correlated with car sales. As the former sales champion of new car-making forces in China, Xiaopeng Motors has continued to carry out organizational reforms since 2023, but from the perspective of market performance, the results have been poor.

As the price war intensified, Xpeng Motors' monthly deliveries in January-April this year were still below 10,000 vehicles, surpassed by Nezha Motors. Specifically, in the first quarter of this year, Xpeng Motors delivered 21,800 vehicles, which was also its lowest delivery volume since the first quarter of 2023.

It is worth mentioning that unlike its competitors whose main source of revenue is car sales, in the first quarter of 2024, Xpeng Motors' service and other revenue was RMB 1.0 billion, up 93.1% from RMB 520 million in the same period of 2023, and up 22.1% from RMB 820 million in the fourth quarter of 2023. Service revenue accounted for 15.5% of total revenue.

It is reported that the growth of this part of revenue is mainly due to the income from technical research and development services related to the strategic technical cooperation between Xpeng Motors and Volkswagen Group on platform and software.

On April 17 this year, Xpeng Motors and Volkswagen Group announced the joint development of an electronic and electrical architecture. According to the agreement, the platform will integrate Xpeng Motors' latest generation of electronic and electrical architecture based on central computing and domain controllers. The jointly developed electronic and electrical architecture is expected to be applied to Volkswagen brand electric vehicles produced in China from 2026.

He Xiaopeng, Chairman of Xpeng Motors, commented on the effect of the cooperation with Volkswagen Group in the earnings conference. He said that through the strategic cooperation with Volkswagen Group, Xpeng Motors has taken the lead in realizing the output and empowerment of self-developed intelligent technology, and Xpeng Motors' industry-leading technology will gain greater market influence and better financial returns.

In the first quarter, Xpeng Motors' gross profit margin increased to 12.9% year-on-year and month-on-month. This is because Xpeng's most expensive model X9 raised its gross profit margin, and nearly 10,000 units of this car were sold in 4 months. However, Xpeng Motors' gross profit margin is still far behind Ideal Auto. In the first quarter, Ideal Auto's gross profit margin remained at around 20% after a decline.

None of the six models currently on sale by Xiaopeng is a hit. But He Xiaopeng doesn't seem to be worried. He said in the earnings conference that we can't just pursue sales, but also look at the quality of development. The increase in gross profit margin is undoubtedly a strong confirmation of this view, but the monthly average of less than 10,000 vehicles is difficult to support Xiaopeng's goal of "doubling performance in 2024 and making up for shortcomings" set at the beginning of the year.

One day before the financial report was released, Xiaopeng Motors released the AI Dimensity system in the hope of further strengthening its intelligent label. AI is seen as the main driving force for Xiaopeng's future performance growth. During the financial report meeting, He Xiaopeng also spent a lot of time looking forward to the future of the new brand MONA (Made Of AI).

He Xiaopeng revealed that the first A-class pure electric sedan of the MONA product series will be unveiled in June this year and will be officially launched and delivered in the third quarter. In the fourth quarter of this year, a new B-class pure electric sedan model of the Xiaopeng brand will also be delivered. This new B-class model plus the incremental contribution of the MONA model make Xiaopeng very confident that the monthly delivery volume will increase significantly year-on-year in the fourth quarter of this year.

Just like NIO launching the Ledao brand, Xpeng's launch of MONA is also seen as a way of downward expansion. The difference between the two is that NIO wants to maximize the benefits of its investment in infrastructure, while Xpeng wants to share the investment costs of AI technology through mid- and low-end models.

Theoretically, MONA is targeting a large audience in the price range of 100,000 to 150,000 yuan, but the problem is that this is BYD's main market. What reason does MONA have for consumers to give up a well-known BYD and choose it instead?

In addition to MONA, are there any other ways for Xiaopeng to quickly increase sales? Someone suggested that Xiaopeng develop an extended-range model, but He Xiaopeng's answer at the earnings conference was: "There is no such plan at present. But the difficulty of switching from extended-range to pure electric is much greater than the difficulty of switching from pure electric to extended-range." This sentence has two meanings, let's take a closer look.

Looking ahead to the second quarter, as MONA and Xiaopeng's new B-class pure electric sedan have not yet been launched, Xiaopeng Motors does not have high expectations for delivery volume. In the second quarter, it expects vehicle deliveries to be between 29,000 and 32,000 units, an increase of approximately 25.0% to 37.9% year-on-year. Total revenue will be between RMB 7.5 billion and RMB 8.3 billion, an increase of approximately 48.1% to 63.9% year-on-year.