In stark contrast to the strained media budgets of car manufacturers and the overwhelming flood of booth invitations, the 2024 Chengdu Auto Show proceeded amidst a chorus of media complaints and pessimism.

From my perspective, this has turned out to be a rare occurrence of a clean and pure auto show in many years. One significant reason for this is that, while being neglected by traffic and attention, this auto exhibition—initially positioned as a “car sales event”—has shifted the focus back onto the vehicles themselves.

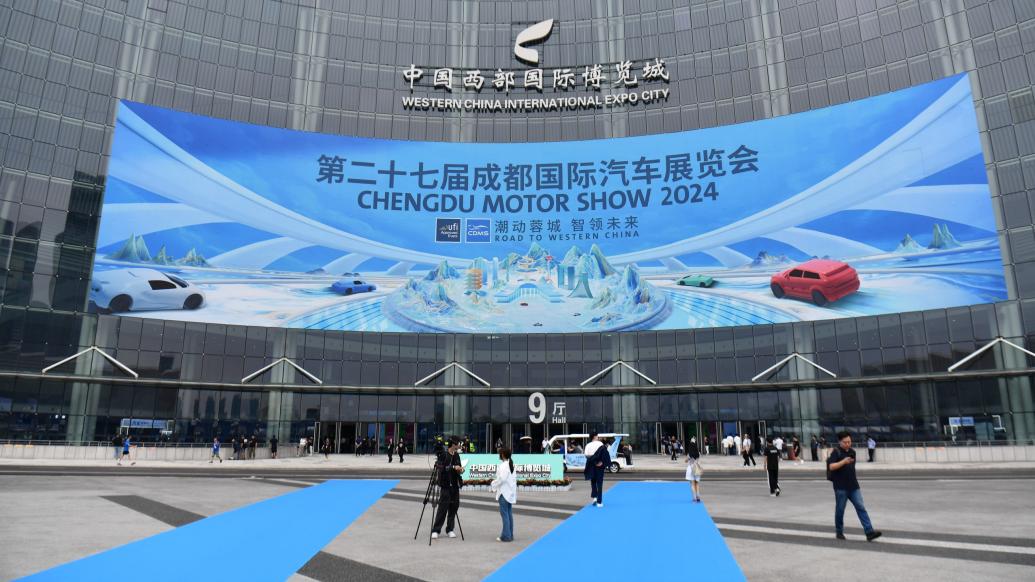

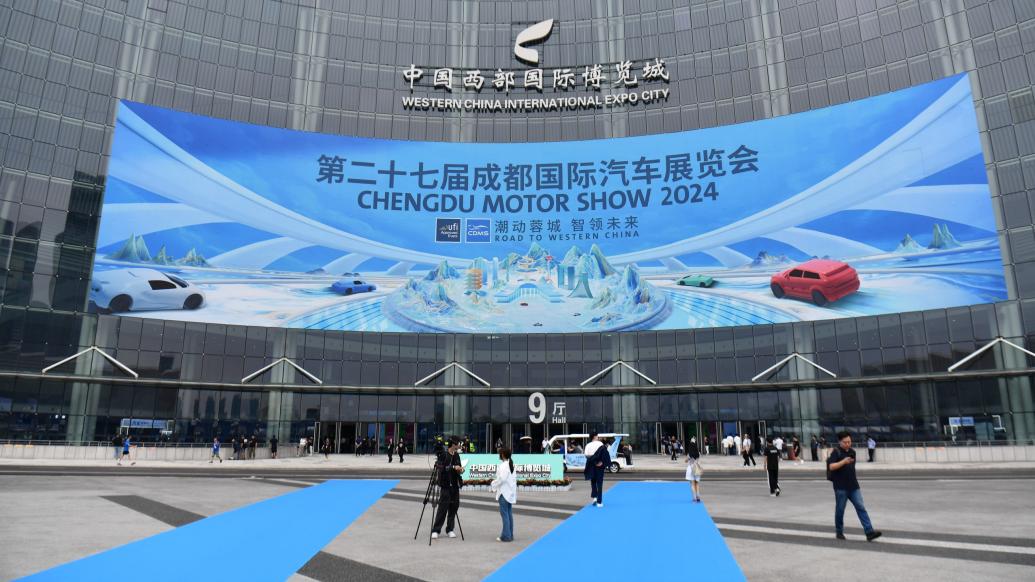

On August 30, 2024, in Chengdu, Sichuan, the 27th Chengdu International Auto Show opened.

A More Pure Auto Show

This year's Chengdu Auto Show may not have the same buzz as the noisy Beijing Auto Show four months ago, which had the flamboyant red-clad figures and digital celebrities like Lei Jun. However, this also means that the thoughtfully arranged booths and product lineups have a greater chance of being noticed, rather than just “spending money to make others look good.”

You might be surprised to learn that the scale of this Chengdu Auto Show is actually larger than the last one. According to official data, 130 exhibiting companies showcased over 1,600 vehicles. The exhibition reached an all-time high in scale, maintaining the previous 11 pavilions and, for the first time, employing Pavilion 9. The outdoor exhibition area has expanded and upgraded, featuring a massive 5,000-square-meter automotive technology display zone, bringing the overall exhibition area to 220,000 square meters.

The Chengdu Auto Show has always played a pivotal role, acting as a frontline lookout tower for auto manufacturers’ fourth-quarter sales push and genuinely aiding the auto market.

Publicly available data shows that last year’s Chengdu Auto Show attracted 902,000 visitors, generating 35,028 orders with a transaction value of 6.087 billion yuan.

The sales revenue from the 2023 Chengdu International Auto Show accounted for 4% of the local annual sales.

According to data from the Passenger Car Association, in 2022 and 2023, Chengdu's car sales ranked third in the country after Shanghai and Beijing. However, in the first seven months of 2024, Chengdu topped the list with a cumulative sales figure of 332,000 vehicles, surpassing both Beijing and Shanghai.

These figures sufficiently demonstrate Chengdu's significance to the southwestern market and even the national auto market, which is unaffected by the level of promotional spending allocated by car manufacturers for this year’s auto show.

Additionally, the city of Chengdu recently announced a 100-million-yuan automotive consumption incentive program. From August 30 to September 20, consumers who purchase new passenger vehicles from participating manufacturers and successfully submit their documentation to the reporting platform can enjoy rewards of up to 8,000 yuan per unit for electric vehicles and 7,000 yuan for fuel vehicles.

Given the clear awareness that the media only consists of journalists during the morning hours, yet salespeople still energetically approach to inquire about purchasing intentions, this demonstrates that the Chengdu Auto Show feels more genuine; its economic value is more easily quantifiable as opposed to the illusory value derived from traffic.

The Survival Instinct of Joint Ventures

With no crowd creating barriers, the technologies and products from various auto brands were presented more directly to the public.

Intelligent driving remains one of the core topics. On one side, CEO of Extreme Leap, Xia Yiping, touted during a live broadcast that pure vision will replace “human driving.” On the other, Deputy General Manager of GAC Aion, Xiao Yong, stated at the press conference that "no laser radar at this stage means no good intelligent driving."

While these two engage from a distance, Senior Vice President of Li Auto, Fan Haoyu, has already announced during the auto show that Li Auto has entered the era of supervised autonomous driving.

Of course, intelligent driving is not exclusive to Chinese brands. Joint venture brands, long criticized for their lagging smart technologies, refuse to fall behind. GAC Toyota brought its strongest product, the Platinum Smart 3X, developed for the Chinese market, and boldly proclaimed, "In the second half of intelligentization, please believe in big manufacturers, believe in GAC Toyota!" Their survival instinct is strong. However, the presence of casual onlookers and beautified figures in the flower beds nearby somewhat undermines the seriousness of this claim.

SAIC Volkswagen, one of China's traditional top three automakers, also held its ground, introducing new fuel models like the Passat Pro and Tiguan Pro. Fu Qiang, the Executive Deputy General Manager of Sales and Marketing at SAIC Volkswagen, said in an interview, “The intelligence of a vehicle has nothing to do with its transmission system... The Passat Pro and Tiguan Pro are the top names in terms of intelligence among fuel vehicles.”

If the previous statements weren’t compelling enough, SAIC Volkswagen’s Tiguan X, starting at 79,900 yuan, boldly entered the price range of the self-owned brands’ “just 998” promotions.

“Brands are moving up, product strength is strengthening, oil and electric vehicles are equal, both in intelligence and power. From 80,000 to 320,000, every price point has our main models,” Fu Qiang declared, sounding the alarm for a counterattack by joint venture brands.

Next door, the Koreans are more aggressive.

At the launch of the IONIQ 5N, Hyundai's marketing and public relations head, Im Yong-il, personally drove onto the stage, demonstrating the importance of this auto show event and signaling that Hyundai will never give up on the Chinese market.

On the evening of media day, Im Yong-il posted on social media—his first time driving onto the scene, feeling nervous but fortunate to park correctly. He expressed hope that the sales of the IONIQ 5N and N brand would go smoothly.

The Onslaught from Self-Owned Brands

However, despite the joint venture brands’ efforts, self-owned brands show no signs of granting them a chance for redemption.

Chang'an Shenlan's General Manager Deng Chenghao delivered a nearly off-the-cuff one-hour speech, meticulously mentioning the configuration highlights of the five models on display, showcasing a profound understanding of the products.

The Chang'an L07, located centrally, became the only mid-size sedan under 200,000 yuan equipped with Huawei Kran Kun smart driving technology, precisely targeting the current hottest plug-in hybrid/incremental market.

By the way, the center stage at the Chang'an Mazda booth features the Mazda EZ-6, a repackaged product of the Shenlan SL03.

Smart brought a mud-caked SUV, the Smart #5, to Chengdu, trying to break free from its previous “small but beautiful” stereotype and aiming to become the king of the jungle. However, against high-profile competitors like Zeekr 7X, Avita 07, and Denza Z9 GT, the only thing people noticed was the mud on the smart vehicle.

Moreover, when it comes to SUVs, Great Wall Motor is a significant contender. Its second-generation Haval H9, promoting a "family off-road" concept, gained significant attention, offering a more mainstream and positive image compared to the so-called “appealing to both men and women” Smart #5.

With the “Ultraman” backing, Dongfeng Honda's Lingxi L electric car exudes confidence, but it remains oblivious to the fact that next to it in Pavilion 2, the returning “Fat Head Fish” brand from SAIC Passenger Vehicles is smilingly preparing to challenge its flagship model, the Civic, with a new-generation MG5.

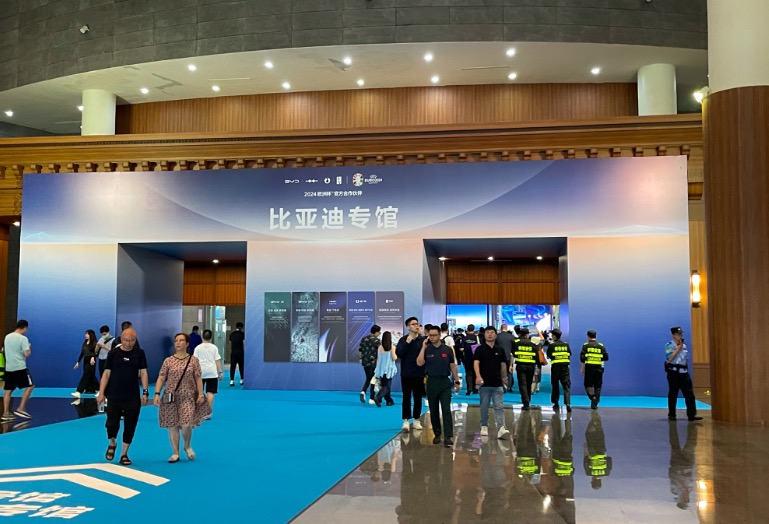

Taking center stage at the entire Western Expo Center is the gloomy dragon known as BYD. From the magnificent entrance of Pavilion 9 to its strategically placed core position, it evokes a gamer’s sense of confronting the “Big Boss.”

Here, unlike other pavilions divided by a central path, the brands under the BYD Group, such as BYD, Yangwang, and Fangcheng Leopard, embrace each other. The middle area features both technology display zones and ample rest areas, creating a mini-city that provides a wealth of information while showcasing a relaxed dominance.

Not Empty, but Composed

Overall, what is reassuring about this year’s Chengdu Auto Show is that within the entire Western Expo Center, people's attention has shifted from mindlessly following trending figures back to the technology and the essence of selling cars itself. At most, Lincoln invited the prominent figure Chen Zhen from the Erhuan Shisanlang to share the stage with the Lincoln Aviator. Considering professionalism, status, and the symbolism of the “Aviator,” both the vehicle and the individual were quite fit.

Outside the venue, if you are lucky, you might see XPeng's flying car soaring in the sky or experience automotive emergency water flotation and witness hardcore technical displays of extreme off-roading.

Therefore, rather than categorizing this year's auto show as quiet, it can be viewed as a moment of enlightenment for car manufacturers and media following the unrestricted growth era of traffic-based communications—indicating a phase of reflection after prolonged competition in the Chinese auto market, a turning point for the Chinese automotive industry transitioning from restlessness to maturity.

If you have attended international auto shows in Tokyo, Detroit, or Paris, you would observe that those venues have always been comparably “calm.”