On October 12, the China Passenger Car Association (CPCA) announced the automotive sales figures for the Chinese market. The data shows that in September, retail sales of narrow passenger vehicles reached 2.109 million units, a year-on-year increase of 4.5% and a month-on-month increase of 10.6%.

For the first nine months of the year, cumulative retail sales totaled 15.574 million units, showing a year-on-year increase of 2.2%. In September, conventional fuel vehicle sales were 990,000 units, representing a year-on-year decrease of 22%; from January to September, sales of conventional fuel vehicles totaled 8.44 million units, down 16% year-on-year.

In September, retail sales of new energy passenger vehicles amounted to 1.123 million units, a year-on-year increase of 50.9% and a month-on-month increase of 9.6%. For the period from January to September 2024, retail sales reached 7.132 million units, up 37.4% year-on-year.

In September, the domestic retail penetration rate for new energy vehicles was 53.3%, marking three consecutive months of penetration rates exceeding 50%.

On August 3, 2024, in Bozhou, Anhui, newly rolled-off vehicles are prepared for delivery.

The CPCA analysis noted that the 10.6% month-on-month growth in new energy retail sales in September reflects a positive market response to the national vehicle scrappage and replacement policy. This policy has achieved balanced growth in both high-end and low-end segments of the market, while local replacement subsidies have boosted growth in the terminal segment.

Moreover, the frequency of price-cut promotions from July to September has been noticeably lower than from February to April, indicating that the price war is stabilizing.

On the other hand, the differentiation among different camps is intensifying.

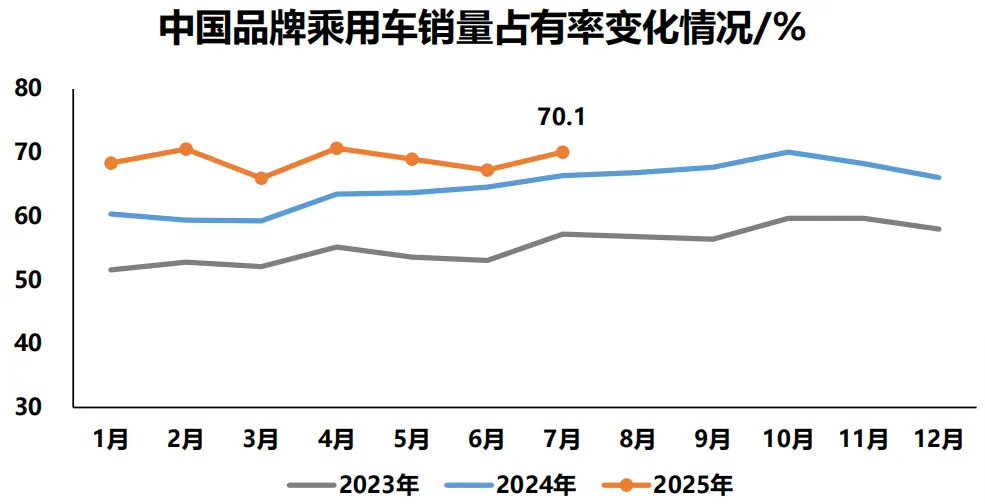

In September, retail sales of domestic brands reached 1.34 million units, marking a year-on-year increase of 25% and a month-on-month increase of 11%. The domestic retail market share for domestic brands was 63.5%, a year-on-year increase of 10.1 percentage points. Traditional automakers such as BYD, Chery, Geely, and SAIC-GM-Wuling have shown significant gains in brand market share.

In contrast, mainstream joint venture brands recorded retail sales of 530,000 units in September, down 22% year-on-year. German brands held a retail market share of 16.5%, down 3.6 percentage points year-on-year, while Japanese brands saw their retail share drop to 12.6%, down 4.0 percentage points. American brands achieved a retail market share of 5.7%, representing a decline of 1.7 percentage points.

Luxury vehicle sales were 250,000 units in September, down 8% year-on-year. The retail market share for luxury brands was 11.7%, a decrease of 1.5 percentage points year-on-year.

In terms of performance, traditional automakers like BYD, Chery, and Geely, as well as new forces like Li Auto and Seres, have benefited from a diversified layout of plug-in hybrids and pure electric vehicles, leading to significant growth this year.

Among them, BYD sold 417,000 units, Chery sold 244,000 units, and Geely sold 202,000 units, achieving remarkable growth ranging from 20% to 45%.

In the new power sector, Li Auto sold 53,709 units in September, while Seres sold 37,200 units. Similarly, Leap Motor also broke through the 30,000-unit mark, reaching 33,767 units.

However, extended-range vehicles are not a universal solution; for instance, Changan Mazda's newly launched EZ-6 extended-range vehicle recorded only 6,010 units in sales for September, down 41.6% year-on-year, with volumes increasingly shrinking.

Overall, the market share for joint venture brands continues to decline, and their performance remains less than optimistic.

Looking ahead to October, the CPCA forecasts that the recent strong surge in the domestic stock market, driven by favorable policies, will attract more funds. Based on results from 2014 to 2016, during sudden stock market booms, it becomes challenging for the auto market to achieve a rapid increase in tandem. However, if the stock market maintains steady upward momentum in the long term, a strengthening auto market will inevitably follow.